“We are holding to our call for two rate cuts this year, with the first in September, as we expect that inflation will continue to moderate.”

— MBA SVP and Chief Economist Mike Fratantoni

“We are holding to our call for two rate cuts this year, with the first in September, as we expect that inflation will continue to moderate.”

— MBA SVP and Chief Economist Mike Fratantoni

RE/MAX, Denver, released a new survey finding that 63% of Millennial and Gen Z respondents are ready to become homeowners, but are discouraged by the current environment.

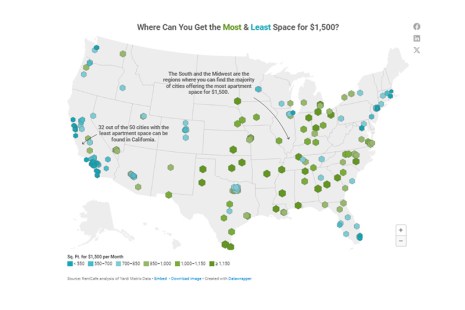

RentCafe, Santa Barbara, Calif., recently analyzed which cities feature the largest apartments for $1,500 monthly rent. Topping the list of big cities was Wichita, Kan., followed by Toledo, Ohio.

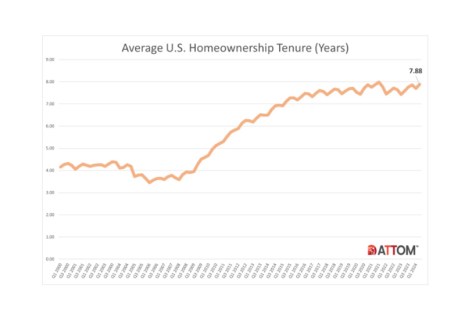

ATTOM, Irvine, Calif., released its second-quarter 2024 U.S. Home Sales Report, which showed that home sellers earned a 55.8% profit margin on typical single-family home and condo sales during the second quarter.

Gantry, San Francisco, secured a $40 million permanent loan to refinance an apartment complex on Mercer Island, a Puget Sound community between Seattle and Bellevue, Wash.

MBA is proud to recognize its Premier and Select Members and to thank them for their continued support of MBA and the real estate finance industry.

Commercial and multifamily developments and activities from MBA important to your business and our industry.

Delinquency rates for mortgages backed by commercial properties declined slightly during the second quarter of 2024.

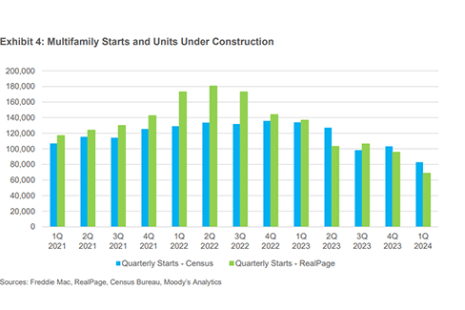

Freddie Mac Multifamily, McLean, Va., expects multifamily performance to remain muted for the remainder of the year as the market works through a historically high supply of new units.

“The delinquency rate for most property types declined last quarter, with the exception of loans backed by office properties, which experienced an increase.”

–Jamie Woodwell, MBA’s Head of Commercial Real Estate Research