Commercial and multifamily developments and activities from MBA important to your business and our industry.

Category: News and Trends

Commercial and Multifamily People in the News Sept. 19, 2024

Industry personnel news from Merchants Bancorp, CBRE, JLL and Peachtree Group.

CMF Quote of the Week: Sept. 12, 2024

“The delinquency rate for loans backed by commercial real estate increased again in the second quarter.”

–Jamie Woodwell, MBA’s Head of Commercial Real Estate Research

Green Street: Commercial Property Prices Up 3.3% This Year

Green Street, Newport Beach, Calif., reported its Commercial Property Price Index increased 1.6% in August. The index–a measure of pricing for institutional-quality properties–is up 3.3% this year.

CMBS Special Servicing Rate Leaps in August, Trepp Finds

Trepp, New York, reported the commercial mortgage-backed securities special servicing rate jumped in August, climbing 16 basis points to 8.46%.

Apply for MBA’s Diversity, Equity, and Inclusion (DEI) Leadership Awards, Due Nov. 1

MBA’s Diversity, Equity, and Inclusion (DEI) Leadership Awards celebrate leading organizations that demonstrate outstanding leadership in DEI initiatives.

Freddie Mac Announces Diana Reid as CEO

Freddie Mac announced that Diana Reid will serve as CEO, effective immediately.

Yardi Matrix: Multifamily Rents Flat in August

Yardi Matrix, Santa Barbara, Calif., released its data on multifamily rents in August, finding that they were essentially flat, with just a $1 drop to $1,741 from July. Year-over-year growth was unchanged at 0.8%.

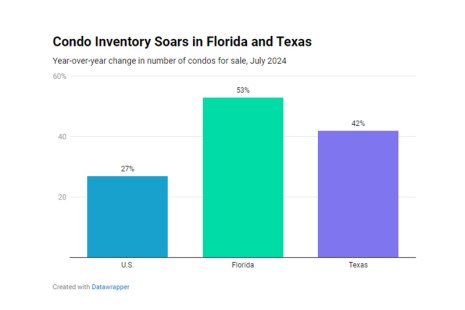

Redfin: Florida, Texas Condo Markets Struggle

Redfin, Seattle, released a recent report looking at condo activity in Florida and Texas amid growing insurance and HOA costs. In major metro areas in both states, inventory is increasing, but pending sales are dropping, the report noted.

To the Point With Bob–Amid Grand Visions, MBA is Tackling Housing Shortage One Program at a Time

The lack of affordable housing is a big issue this election year, writes MBA President and CEO Bob Broeksmit, CMB.