CoreLogic, Irvine, Calif., released its Single-Family Rent Index for November, finding that single-family rent growth slowed to 1.5% year-over-year. That’s the lowest annual increase in more than 14 years.

Category: News and Trends

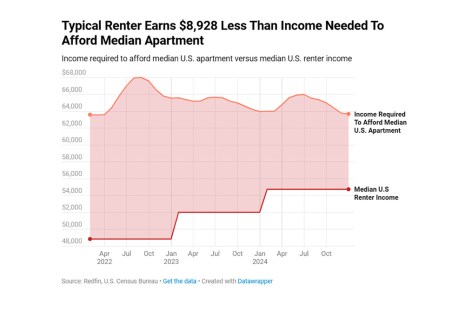

Redfin: Amount Renters Need to Earn Drops

Redfin, Seattle, found that renters need to earn $63,680 to afford the $1,592 median asking rent for a U.S. apartment, the lowest amount needed since March 2022.

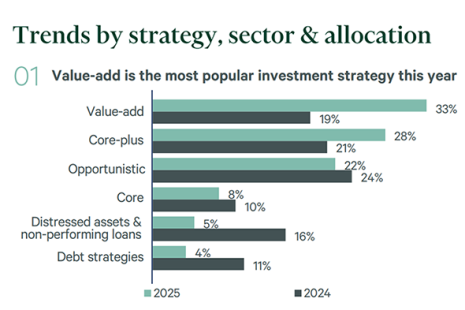

Investors Poised to Deploy More Capital in 2025: CBRE

CBRE, Dallas, said investors are gearing up to inject more capital into the U.S. commercial real estate market this year, driven by favorable pricing and despite the challenges posed by interest rate fluctuations.

Hotel Construction Reaches Historic High

Lodging Econometrics, Portsmouth, N.H., reported U.S. hotel construction hit a new high in the fourth quarter.

CREF Policy Update: MBA and State/Local Partners Join Broad Industry Call for Key Small Business Deduction Extension

Commercial and multifamily developments and activities from MBA important to your business and our industry.

MBA Statement on the Confirmation of Scott Bessent as Treasury Secretary

MBA’s President and CEO Bob Broeksmit, CMB, released a statement on Scott Bessent’s confirmation to serve as the next Secretary of the Treasury.

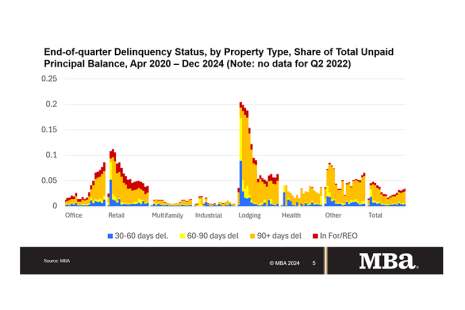

MBA: Delinquency Rates for Commercial Properties Increased in Fourth-Quarter 2024

Delinquency rates for mortgages backed by commercial properties increased during the fourth quarter of 2024, according to the Mortgage Bankers Association’s (MBA) latest commercial real estate finance (CREF) Loan Performance Survey.

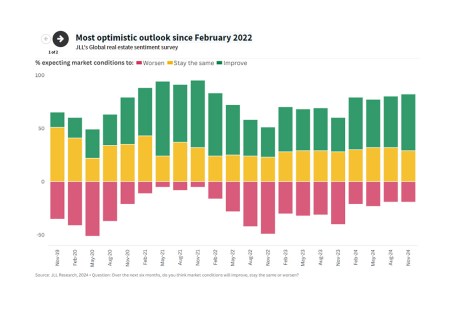

JLL: Global Real Estate Sentiment Strongest Since Early 2022

JLL, Chicago, released its outlook for 2025, making predictions about the year ahead for commercial real estate.

Moody’s: Commercial Real Estate Sees Mixed Results in Q4

Moody’s, New York, released a look at Q4 2024 trends for commercial and multifamily real estate, finding in large part a continuation of trends from past quarters.

KBRA Says CMBS Ended 2024 on High Note

KBRA, New York, reported commercial mortgage-backed securities ended the year on a high note, as issuance exceeded $100 billion in 2024—a level experienced only once since the global financial crisis.