Moody’s: Commercial Real Estate Sees Mixed Results in Q4

(Image courtesy of Kelly/pexels.com)

Moody’s, New York, released a look at Q4 2024 trends for commercial and multifamily real estate, finding in large part a continuation of trends from past quarters.

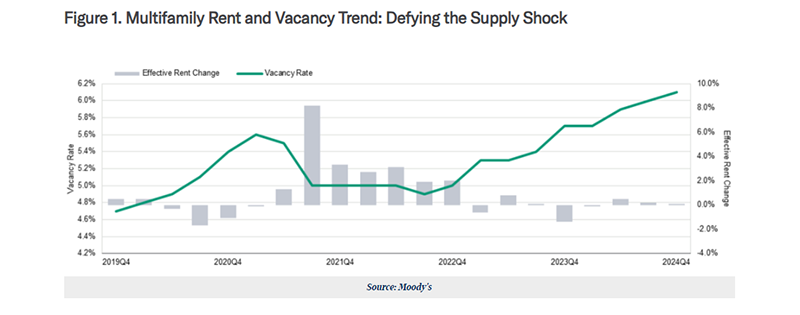

Multifamily saw a solid quarter, as it continued to weather the supply influx.

The national asking rent currently stands at $1,850, just below the all-time high of $1,851 notched in Q3 2023.

The sector did see a 10-basis-point vacancy rate increase to finish 2024 at 6.1%, up 40 basis points year-over-year. However, that’s amid record-level inventory growth and steady demand.

Effective rent growth tempered, in part due to the elevated vacancy rate leading to longer lease-up times and encouraging concessions. Effective rent growth slowed from 0.5% earlier in 2024 to just 0.1% in Q4 and stands at $1,757, just $12 below the record.

Completions are likely to slow in 2025; Moody’s anticipates a declining vacancy rate and larger rent growth in the year ahead.

The office sector’s vacancy rate continues to climb–it finished the year at a record high of 20.4%. Since January 2024, the vacancy rate rose 80 basis points, with 30 of those basis points recorded in Q4.

The retail sector’s vacancy rate was flat at 10.3%, and both asking and effective rent grew by 0.3%–they are at $21.90 per square foot and $19.19 per square foot, respectively.

The industrial sector continued to stabilize in the quarter, as supply and demand rebalance. The vacancy rate, at 6.9%, fell 10 basis points from Q3 but is up 50 basis points from Q4 2023.

New construction starts in the sector have slowed, but overall construction levels remain healthy.

Both asking and effective rent grew by 0.3%. That’s down slightly from Q3, when both grew by 0.5%.