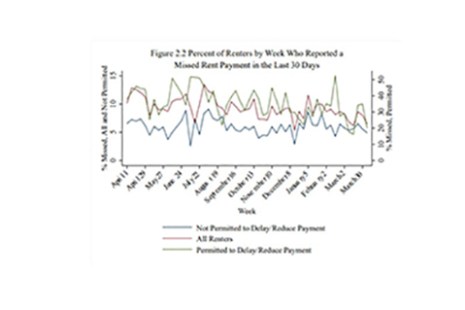

Slightly under five million households did not make their rent or mortgage payments in March, an improvement from December 2020 and the lowest number since the onset of the COVID-19 pandemic, new research from the Mortgage Bankers Association’s Research Institute for Housing America reported.

Category: News and Trends

Dealmaker: Gantry Arranges $18M for Two Suburban Business Parks

Gantry, San Francisco, secured $17.5 million to refinance two suburban office parks in two states owned by a Seattle-based private family office.

Berkadia’s Terry Wellman Discusses Affordable Housing and MBA’s New FHA Affordable/221(d)(4) Underwriter Training Program

MBA NewsLink interviewed Terry Wellman, FHA Chief Underwriter for Affordable at Berkadia, about affordable housing and MBA’s new FHA Affordable/221(d)(4) Underwriter Training Program.

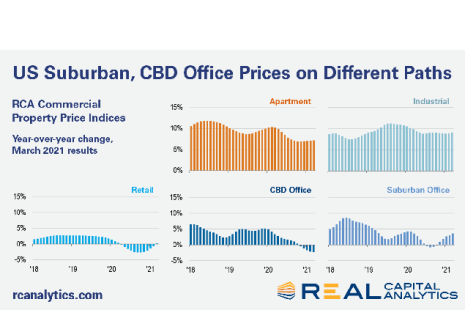

CRE Price Trends Diverge Across Property Types

Commercial real estate asset prices diverged by property type during the first quarter.

The Business Case for Sustainable Real Estate Development Goals

The Urban Land Institute, Washington, D.C., reported real estate organizations are increasingly expected to align with the United Nations’ Sustainable Development Goals by investing in environmental, social and corporate governance.

Dealmaker: Merchants Capital Secures $18M for NYC Affordable Housing Capital Improvements

Merchants Capital’s New York office closed an $18.2 million Housing Development Corporation Fannie Mae Risk Share loan for Mannie Wilson Towers, a historic affordable housing development in Manhattan’s Harlem neighborhood.

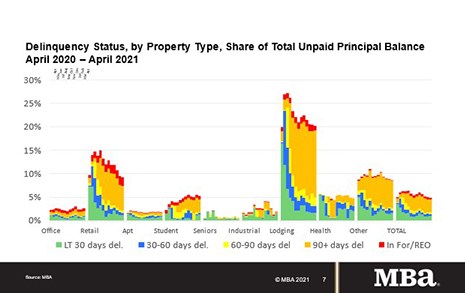

MBA: April C/MF Mortgages Delinquencies Decline

Delinquency rates for mortgages backed by commercial and multifamily properties decreased again in April, reaching the lowest level since the onset of the COVID-19 pandemic, the Mortgage Bankers Association’s latest monthly CREF Loan Performance Survey reported.

Hotel Recovery Reaches ‘Plateau’

The hotel sector’s recovery continues, though it has “plateaued” for the moment, analysts with STR and Trepp LLC reported.

CMBS Market Musings: Trophy Asset, Transitional Loan Transactions Thrive

The private-label CMBS market remains a mixed bag, showing signs of a K-shaped recovery in the second quarter with delinquency and default numbers trending down now for nine consecutive months.

Personnel News From NorthMarq, Walker & Dunlop, KBRA

Eduardo Padilla, Executive Chair of NorthMarq, announced he is retiring May 14 after nearly 30 years with the company.