MBA: April C/MF Mortgages Delinquencies Decline

Delinquency rates for mortgages backed by commercial and multifamily properties decreased again in April, reaching the lowest level since the onset of the COVID-19 pandemic, the Mortgage Bankers Association’s latest monthly CREF Loan Performance Survey reported.

“Commercial and multifamily mortgage delinquency rates declined in April but remain elevated overall, driven by the continuing challenges facing many hotel and retail properties,” said Jamie Woodwell, MBA Vice President of Commercial Real Estate Research. “New and early-stage delinquencies have fallen significantly from earlier in the pandemic, but later-stage delinquency rates have stayed high, as lenders and servicers work through the options for troubled properties. “

Woodwell said vaccine rollouts, strong consumer balance sheets and pent-up demand are all positive signals, “both for new delinquencies and for working out troubled properties,” he said.

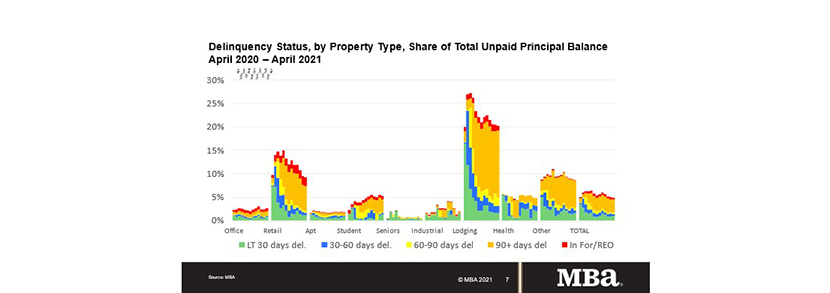

Key Findings from MBA’s CREF Loan Performance Survey for April:

The balance of commercial and multifamily mortgages that are not current decreased again in April to its lowest level since April 2020.

- 95.1% of outstanding loan balances were current, up from 95.0% in March.

- 3.2% were 90+ days delinquent or in REO, unchanged from a month earlier.

- 0.3% were 60-90 days delinquent, unchanged from a month earlier.

- 0.4% were 30-60 days delinquent, down from 0.5% a month earlier.

- 1.1% were less than 30 days delinquent, up from 0.9%.

Loans backed by lodging and retail properties continue to see the greatest stress, but also the most improvement.

- 20.2% of the balance of lodging loans were delinquent, down from 20.5% a month earlier.

- 9.3% of the balance of retail loan balances were delinquent, down from 9.5% a month earlier.

- Non-current rates for other property types were modestly higher during the month.

- 1.9% of the balances of industrial property loans were non-current, up from 1.2% a month earlier.

- 2.6% of the balances of office property loans were non-current, up from 2.4% a month earlier.

- 1.7% of multifamily balances were non-current, down from 1.8% a month earlier.

Because of the concentration of hotel and retail loans, CMBS loan delinquency rates are higher than other capital sources.

- 8.5% of CMBS loan balances were non-current, down from 8.7% a month earlier.

- Non-current rates for other capital sources were more moderate.

- 2.1% of FHA multifamily and health care loan balances were non-current, unchanged from a month earlier.

- 2.0% of life company loan balances were non-current, up from 1.6%.

- 1.1% of GSE loan balances were non-current, down from 1.2% a month earlier.

MBA’s CREF Loan Performance survey collected information on commercial and multifamily mortgage portfolios as of April 20. This month’s results build on similar monthly surveys conducted since April 2020. Participants reported on $2.0 trillion of loans in April, representing approximately half of the total $3.9 trillion in commercial and multifamily mortgage debt outstanding.

Click here for more information on MBA’s CREF Loan Performance Survey.