Meridian Capital Group, New York, arranged $171.6 million to refinance newly constructed multifamily property One Museum Square in Los Angeles, on behalf of JH Snyder Co., Los Angeles.

Category: News and Trends

1Q Distressed CRE Debt Drops

More U.S. commercial real estate distress was worked out than arose in the first quarter, sector analysts reported.

Peter Muoio of SitusAMC Insights: Migration Out of Big Cities Opportunity for Some Who Previously Couldn’t Afford It

Peter Muoio is head of SitusAMC’s Insights division, a provider of technology and services to the real estate finance industry. He has more than 30 years of research and analytics experience in the commercial real estate industry.

Seattle Eclipses Manhattan as Top Market for Cross-Border Buyers

Seattle surpassed Manhattan to become the leading U.S. market for cross-border investment, reported Real Capital Analytics, New York.

Personnel News From Walker & Dunlop, DLA Piper, CBRE

Walker & Dunlop, Bethesda, Md., hired John Ducey as Affordable Chief Production Officer. He will lead the firm’s affordable housing financing efforts across all capital sources, including Fannie Mae, Freddie Mac and private capital providers.

Commercial/Multifamily Briefs from Freddie Mac, Canyon Partners

Freddie Mac, McLean, Va., priced a new offering of Structured Pass-Through K Certificates that included a class of floating-rate bonds indexed to the Secured Overnight Financing Rate.

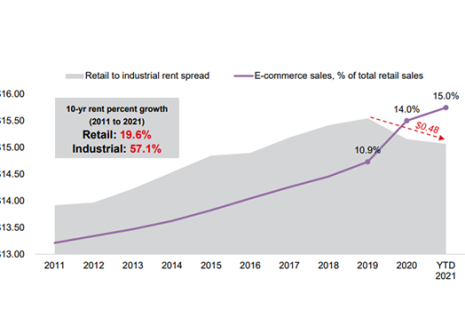

Spread Between Retail, Industrial Rents Compresses

JLL, Chicago, reported the spread between retail property rents and industrial property rents is compressing as home deliveries speed up and e-commerce steals more and more market share from brick-and-mortar retailers.

Quote

“The most interesting thing about the pandemic recovery is that the entire U.S. isn’t recovering at the same pace.”–Peter Muoio, head of SitusAMC’s Insights division

Commercial/Multifamily Briefs From Cohen & Steers, Fannie Mae

Cohen & Steers, New York, an investment manager specializing in real assets and alternative income, formed the Cohen & Steers Private Real Estate Group, a team purpose-built for private real estate investing.

CREF Policy Update May 27, 2021

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.