Investor interest in life sciences real estate has jumped during the pandemic, analysts said.

Category: News and Trends

Quote

“Well-intentioned but misguided legislation like the Carried Interest Fairness Act and the President’s budget proposal to tax carried interests as ordinary income, would result in an enormous tax increase on countless Americans who use partnerships to develop, own and operate real estate. These sweeping changes, if enacted, would discourage individuals from pursuing their entrepreneurial vision, tax the sweat equity that makes real estate more productive and useful and slow economic growth. The results would be particularly harmful to industries that seek to build a business or asset with lasting value over an extended time horizon.”

–From an MBA/trade group letter to Capitol Hill opposing legislation and an Administration budget proposal that would broadly change tax laws on “carried interest.”

Personnel News From Greystone, CBRE

Greystone, New York, announced Sampada D’silva joined the firm as a Deputy Chief Credit Officer.

Wells Fargo Economics: CRE Prospects Brighten

Wells Fargo Economics, Charlotte, N.C., said surging economic activity could signal a turnaround in commercial real estate fundamentals.

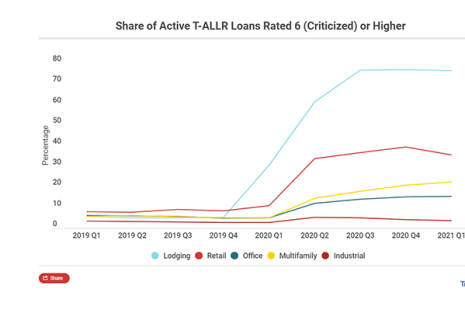

Mixed Results for CRE Bank Loan Performance

Trepp, New York, reported “mixed results” for bank commercial real estate loan performance in the first quarter.

Dealmaker: Newmark Arranges $500M Acquisition, Construction Loan for 111 Wall Street

Newmark, New York, closed a $500 million acquisition and construction loan for 111 Wall Street in Manhattan’s Financial District.

Personnel News From Greystone, CBRE

Greystone, New York, announced Sampada D’silva joined the firm as a Deputy Chief Credit Officer.

Apartments Grow as Work from Home Spreads

RENTCafé, Santa Barbara, Calif., reported many apartments are growing larger, in part due to increased working from home.

Most Senior CMBS Found ‘Resilient’ Under Stress Test

Most high investment-grade rated commercial mortgage-backed securities multi-borrower bonds can withstand downgrades under a new hypothetical stress test, Fitch Ratings reported last week.

State of the Nation’s Housing: Millions Face Risk of Eviction, Foreclosure

Households that weathered the pandemic without financial distress are “snapping up” the limited supply of homes for sale, pushing up prices and excluding less-affluent buyers from homeownership, the Joint Center for Housing Studies at Harvard University reported Wednesday.