Wells Fargo Economics: CRE Prospects Brighten

Wells Fargo Economics, Charlotte, N.C., said surging economic activity could signal a turnaround in commercial real estate fundamentals.

“The economy has gained considerable momentum this spring as a larger share of the population has gotten vaccinated and daily new COVID infections have plummeted,” Wells Fargo Economics said in its First Quarter 2021 CRE Chartbook. “Restrictions on business operations have also loosened, most notably in some of the largest and hardest-hit metro areas such as New York, Boston, Chicago and Los Angeles.”

Well Fargo estimates real GDP grew at an “astonishing” 10.9 percent annual rate during the second quarter.

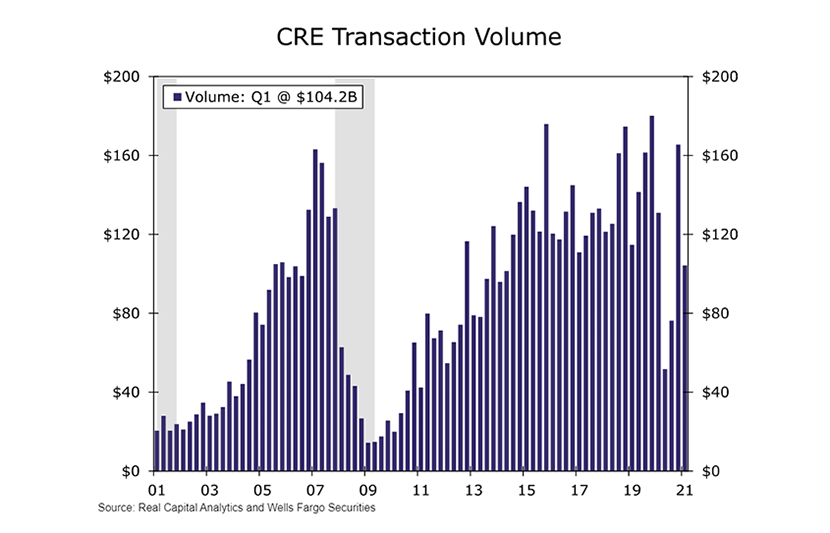

“The resurgence in economic activity looks to be a harbinger for a turnaround in commercial real estate fundamentals,” the report said. “One key concern hanging over the market has been that the ill effects of the pandemic would ignite a wave of distressed asset sales, which would trigger a substantial decline in property valuations. While there is still a sizable supply of potentially distressed loans, the number of ‘worked-out’ distressed loans exceeded newly troubled loans in the first three months of the year, according to Real Capital Analytics.”

In addition, commercial property prices continue to climb, boosted by exceptionally low interest rates. The NCREIF National All-Property Price Index rose 8.4 percent on a year-over-year basis in April, with nearly every major property type except for central business district offices showing an annual gain.

“Perhaps the most rapid turnaround so far has been in the apartment market,” Wells Fargo said. “Vacancy rates plummeted in the first quarter as leasing activity picked up substantially.” Apartment asking rents jumped 2.3 percent, the strongest quarterly gain since Wells Fargo Economics began tracking the sector in 2002, and demand appears to be strengthening in both urban areas and the suburbs.

As COVID-related risks fade, the return to the office now looks more imminent, the report noted. This caused a “rush” to secure a lease on favorable terms. “With demand returning, the generous concessions landlords started offering to attract and retain [office] tenants have diminished considerably,” the report said.

As vaccination spreads, people are shopping and dining out again, which boosts demand for retail space, the Chartbook said. Sequentially, retail asking rent growth entered positive territory in the first quarter, the first increase since early 2020. “Consumer spending is set to surge this year, which will bolster retail developments with restaurants, gyms and other high-contact tenants,” the report said.

Travel and tourism are also growing significantly, “which comes as welcome news to the hotel industry,” the report said. “Hotel occupancy rates, average daily rates and revenue per available room have all improved in recent months, but still remain below pre-pandemic levels,” it said. “Leisure travel is recovering quickly, but business and international travel may take longer to come back.”