MISMO®, the real estate finance industry standards organization, seeks public comment on a proposed standard for Commercial Green Utility Data. The 90-day comment period begins June 30 and runs through September 30.

Category: News and Trends

MBA, Trade Groups Urge Fairness on ‘Carried Interest;’ Support for ‘INVEST in America’ Bill

The Mortgage Bankers Association and more than a dozen industry trade groups warned Congress that legislation and a separate Biden Administration proposal to change longstanding tax laws on “carried interest” could have damaging implications for Americans who use partnerships to develop, own and operate real estate.

CBRE: U.S. Needs 330M Square Feet of Distribution Space to Meet eCommerce Demand

CBRE, Dallas, estimated the U.S. will need an additional 330 million square feet of distribution space by 2025 just to handle projected increases in online ordering.

CREF Policy Update July 1, 2021

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

Personnel News: Walker & Dunlop, Greystone, The Mogharabi Group

Walker & Dunlop, Bethesda, Md., hired Susan Mello as Group Head of Capital Markets.

‘New Cracks’ in Affordable Housing Foundation

Fitch Ratings, New York, said the coronavirus pandemic “created new cracks” in the already fragile foundation of affordable housing.

Dealmaker: Mesa West Originates $40M for Austin Apartments

Mesa West Capital, Los Angeles, originated $40 million in first mortgage debt to finance an off-market acquisition of a 309-unit Austin, Texas apartment property.

Cities With More Remote-Friendly Jobs See Slower Office Market Recovery

Office markets in cities with a greater percentage of remote-friendly jobs are recovering more slowly than in cities with fewer such jobs, reported VTS, New York.

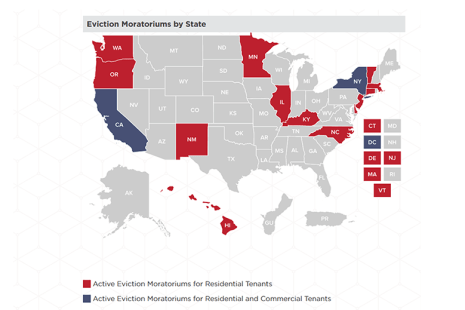

CDC Extends National Eviction Moratorium For Final Time to July 31

The Centers for Disease Control and Prevention last Thursday extended its nationwide residential eviction moratorium by another month, to July 31.

White House Names Sandra L. Thompson Acting FHFA Director

The White House last week appointed Sandra L. Thompson as Acting Director of the Federal Housing Finance Agency.