Merchants Capital, Carmel, Ind., secured more than $141 million in financing for Waterfront Station II, a mixed-income mixed-use property currently under construction in Washington, D.C.

Category: News and Trends

Freddie Mac: Favorable Multifamily Investment in 3Q

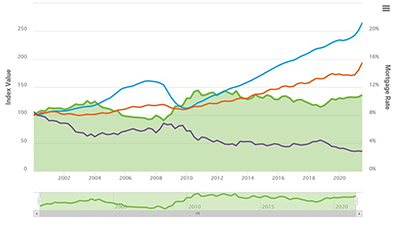

Freddie Mac, McLean, Va., said its Multifamily Apartment Investment Market Index remained positive in the third quarter, driven by net operating income growth, bolstering the investment environment for multifamily properties.

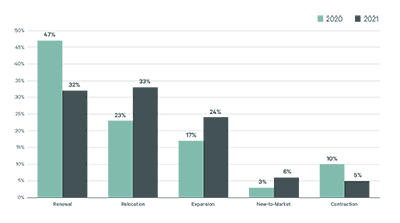

Office Expansions Outpace Contractions in Large Markets

Companies stopped standing still last year when it comes to long-term real estate decisions, reported CBRE, Dallas

Small-Cap CRE: Smaller Markets Outperform Larger Ones

As the national economy rebounded last year, smaller markets outperformed larger markets in the small-cap space, reported Boxwood Means LLC, Stamford, Conn.

CREF Policy Update Jan. 20, 2022

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

Quote

“Green premiums are temporary; brown discounts are forever.” –Guy Grainger, JLL Global Head of Sustainability Services and ESG.

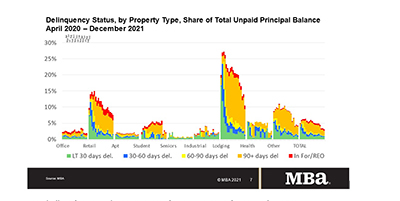

MBA: 4Q Commercial, Multifamily Mortgage Delinquencies Decline

Delinquency rates for mortgages backed by commercial and multifamily properties declined in the final three months of 2021, the Mortgage Bankers Association’s latest CREF Loan Performance Survey reported.

CREF Policy Update Jan. 13, 2022

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

MBA CREF Outlook Survey: Originators Bullish on 2022 Outlook

Commercial and multifamily mortgage originators anticipate 2022 will be another strong year of borrowing and lending, according to the Mortgage Bankers Association’s 2022 Commercial Real Estate Finance Outlook Survey.

2021 Commercial Property Prices Increase Nearly 25%

Green Street, Newport Beach, Calif., said its commercial property price index increased 24 percent in 2021 with robust price appreciation occurring in virtually every corner of the CRE market.