Freddie Mac: Favorable Multifamily Investment in 3Q

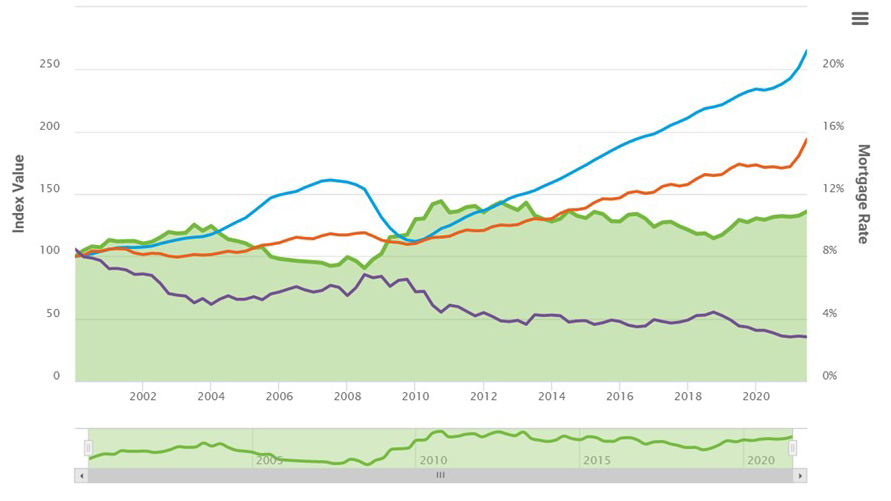

Freddie Mac, McLean, Va., said its Multifamily Apartment Investment Market Index remained positive in the third quarter, driven by net operating income growth, bolstering the investment environment for multifamily properties.

Overall, the index rose by 2.6% quarterly and 3.5% annually, with every market examined posting a positive number in the third quarter for the first time since 2019. Mortgage rates, a component of the index, decreased over the quarter by 5 basis points, offsetting the 5-bps increase last quarter, but remain down 37 bps year over year.

“Markets across the country are rebounding strongly from the impact of COVID-19, including those that were hit hardest by the pandemic,” said Steve Guggenmos, Freddie Mac vice president of Multifamily Research & Modeling.

Over the quarter, AIMI increased in the nation and all 25 markets. Other key findings:

• NOI growth was universally positive for markets and the nation. NOI grew the fastest in New York and Tampa at 13.2% and 11.5%, respectively. Even the slowest growing metro, Minneapolis, posted a strong growth of 3.8%.

• Property prices grew in the nation and in 24 of the 25 markets; New York was the only metro to experience a decline at -1.8%.

• Mortgage rates held relatively steady, decreasing by 5 bps, offsetting the 5-bps increase seen last quarter.

• Over the year, AIMI increased in the nation and in 23 markets, while the Jacksonville, Florida and Minneapolis markets experienced a modest AIMI drop.

• NOI increased in the nation and all 25 markets. Two markets saw NOI increase by 25% or more over the past year: Tampa and Phoenix saw NOI growth of 25.0% and 27.4% respectively. The lowest NOI growth over the past year was seen in San Francisco at 1.7%.

• The nation and all but one market experienced property price growth. New York was the only market that saw property prices decline.

• Mortgage rates decreased by 26 bps over the past year.