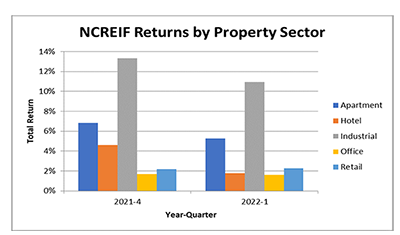

“The strong momentum in commercial and multifamily borrowing and lending at the end of 2021 carried into the first quarter. The continued growth in lending activity is the result of the ongoing strong demand for certain property types like industrial and multifamily, as well as renewed interest in other property types that saw more dramatic declines during the early stages of the pandemic, such as hotel and retail.”

–Jamie Woodwell, MBA Vice President of Commercial Real Estate Research.