Continuing Strong Performance for Institutional-Grade Real Estate

The National Council of Real Estate Investment Fiduciaries, Chicago, reported institutional-quality commercial real estate returned 5.33 percent in the first quarter.

The quarterly return consisted of 0.99 percent from income and 4.34 percent from appreciation. (Appreciation is after the deduction of capital expenditures.) Market values before considering capital expenditures increased by 4.49 percent, NCREIF said.

The index slipped from its record-setting 6.15 percent fourth quarter return, NCREIF said. The rolling annual return for the past four quarters equaled 21.87 percent, the highest since early 1980 and the second highest in the indexes’ 44-year history.

The first quarter’s 5.33 percent return represented the unleveraged returns for primarily “core” real estate held by institutional investors throughout the U.S. Properties with debt financing had a 6.59 percent leveraged total quarterly return, the report said.

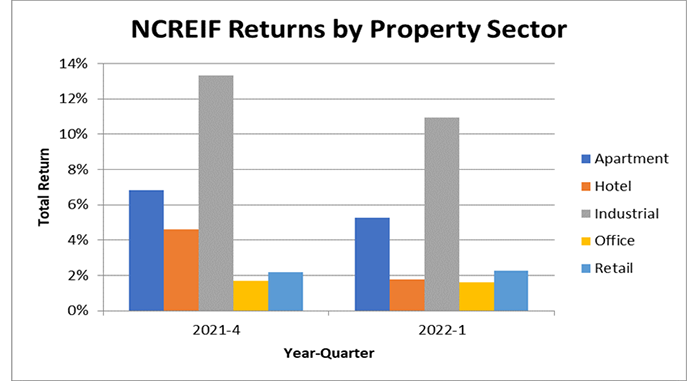

The industrial sector continues to propel the entire index. “The story continues to be the exceptionally strong performance of the industrial–primarily warehouse–sector,” the report said. The sector’s total return in the first quarter approached 11 percent, down from 13.34 percent in late 2021 but still the highest of any property sector.

Apartment properties saw the second highest return, 5.25 percent. “Surprisingly, the third-best performance was from retail properties with a first quarter return of 2.26 percent,” the report said. Hotel and office returns equaled 1.76 percent and 1.60 percent, respectively, NCREIF reported.

The report found market value weighted capitalization rates dropped from 3.83 percent during the fourth quarter to 3.71 percent for the first quarter despite rising interest rates. “This suggests that for the portfolio of NCREIF properties, investors are willing to buy at a 3.71 percent current yield,” NCREIF said. This translates to a 26.95 price-to-earnings ratio and suggests investors expect some growth in the price of institutional-grade commercial real estate.

The NPI’s average market value weighted cap rate is 6.59 percent, which implies a 15.18 price-to-earnings ratio. The S&P 500 index’s price-to-earnings ratio equaled 21.33 as of April 25 compared to the end of quarter NPI price-to-earnings ratio of 26.95.