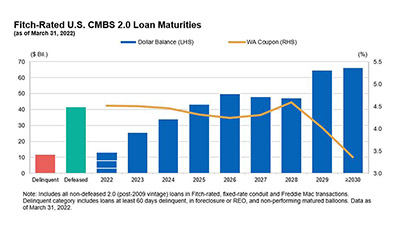

Fitch Ratings, New York, reported the U.S. commercial mortgage-backed securities delinquency rate fell by 22 basis points to 2.10% in May, amid strong retail resolution volume and robust new issuance.

Category: News and Trends

Life Sciences Job Growth Spreads To Smaller Markets

CBRE, Dallas, said the fast-growing life sciences real estate sector now extends beyond coastal research hubs for which it is mostly known.

Quote

“Driven by record-high originations for a first quarter, the amount of commercial and multifamily mortgage debt outstanding climbed to a new high at the end of March.”

–Jamie Woodwell, MBA Vice President of Commercial Real Estate Research.

FHFA, GSEs Detail Equitable Housing Finance Plans

The Federal Housing Finance Agency on Wednesday offered details of the government-sponsored enterprises’ Equitable Housing Finance Plans for 2022-2024.

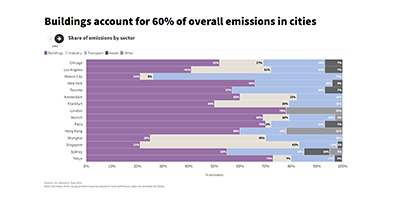

Decarbonizing Cities and Real Estate

City governments are setting rules to move to a net-zero economy. But their ambitious sustainability targets won’t be achieved without an active program to significantly reduce emissions from buildings, said JLL, Chicago.

Industrial Real Estate Construction Reaches Record

Transwestern, Houston, said industrial real estate construction volume set a record in the first quarter as demand for the sector intensifies.

MBA Launches Commercial Real Estate Finance Student Fellowship Program

The Mortgage Bankers Association launched a new fellowship program for students from underrepresented groups interested in learning more about internships, jobs and careers in the $4 trillion commercial real estate finance industry.

Dealmaker: Eastern Mortgage Capital Funds $61M in HUD 223(f) Loans

Eastern Mortgage Capital, Burlington, Mass., provided $61 million for multifamily properties in Connecticut and Maine.

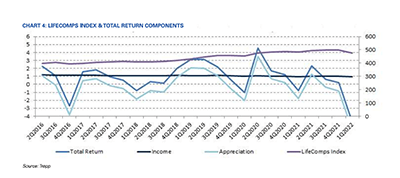

Disruptions Sink Life Insurance Mortgage Returns

Trepp, New York, said life company investments are feeling the effects of major market events that have taken place since early 2022.

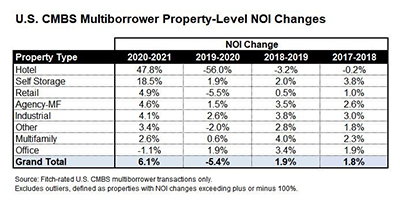

Fitch: CMBS Properties See NOI Recovery

Fitch Ratings, New York, reported property-level net operating income for commercial mortgage-backed securities loans rebounded 6.1 percent on average in 2021.