Disruptions Sink Life Insurance Mortgage Returns

Trepp, New York, said life company investments are feeling the effects of major market events that have taken place since early 2022.

“The lingering effects of the pandemic, such as supply chain disruptions and inflation, were only exacerbated by global headlines,” Trepp said in its quarterly LifeComps report.

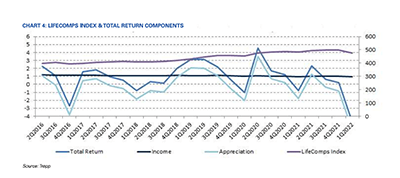

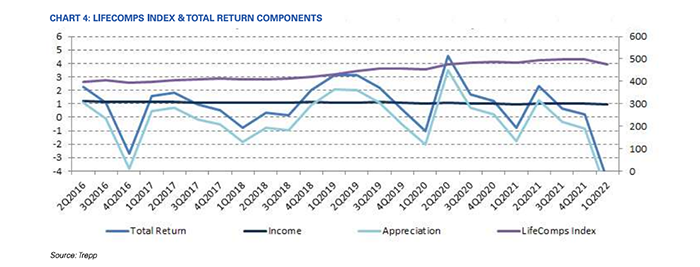

The LifeComps portfolio depreciated 5.77 percent in a 12-month change, Trepp said.

Multifamily properties took the hardest hit with a -5.33 percent total return in the first quarter alone, Trepp said. Retail and hotel property loans had lower realized losses of -3.08 percent and -3.32 percent, respectively.

“Office property uncertainty is at the forefront of investors’ minds,” said Trepp Associate Jennifer Dimaano, noting office occupancy in the LifeComps portfolio was only 89 percent, below only hotels at 46 percent. “Nearly two-thirds of the loans that have been sold in the LifeComps portfolio are comprised of office property loans. Investor sentiment regarding office space remains uncertain as downsizing becomes a growing trend amongst office occupiers.”

But despite the asset depreciation, interest payments still surpass the interest due, so interest income will drive total returns in the upcoming months, the report said.

Trepp noted the 10-year Treasury stands at its highest level since early 2019 and the lingering effects of persistently high inflation pushed the Consumer Price Index to a 12-month high 8.5 percent in March, the highest rate of inflation seen since the 1980s. The Federal Reserve raised interest rates by a quarter of a percent in March to combat inflation, followed by another 50-basis point increase in May, and will likely increase rates again later this year. “The rise in [interest] rates can impact real estate by making lending more expensive and pushing cap rates higher, signaling a possible slowdown in commercial real estate investments,” the report said.