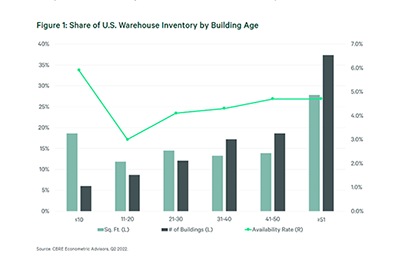

The advanced age of U.S. warehouses–43 years on average–is spurring record construction as big e-commerce and retail distributors demand larger, more modern facilities, reported CBRE, Dallas.

Category: News and Trends

Closing the Racial Capital Gap

Enterprise Community Partners, Columbia, Md., said access to capital remains the biggest hurdle facing small-scale Black, Indigenous and other people of color real estate developers–and it suggests some solutions.

Freddie Mac Apartment Investment Index Falls

Freddie Mac, McLean, Va., said multifamily market investment conditions continued their deterioration in the second quarter as price appreciation and rising mortgage rates more than offset net operating income growth.

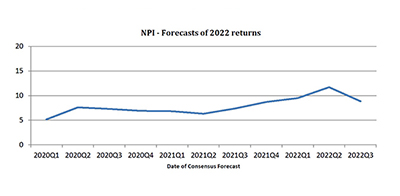

Institutional Investors Lower Return Expectations

Institutional investors are lowering their real estate return expectations, the Pension Real Estate Association reported.

MISMO Seeks Nominations for Standards Governance Committee Members

MISMO® seeks nominations for qualified industry professionals to serve on MISMO’s Standards Governance Committees for a two-year term beginning in January 2023. Positions are available on both the Residential and Commercial Standards Governance Committees.

MBA: 2Q Commercial/Multifamily Mortgage Debt Outstanding Up by $99.5B

Commercial/multifamily mortgage debt outstanding increased by $99.5 billion (2.3 percent) in the second quarter, the Mortgage Bankers Association reported in its quarterly Commercial/Multifamily Mortgage Debt Outstanding report.

Inflation’s Impact on Retail Real Estate

Colliers International, Toronto, said consumers are not alone in feeling elevated inflation–higher costs are problematic for retailers, too.

A Decade in the Making: KBRA on SFR Trends and Outlook

KBRA, New York, recently published a report, SFR Securitizations: A Decade in the Making, analyzing the sector’s evolution and growth. MBA Newslink interviewed the report’s authors about the factors driving the sector’s growth.

MBA CREF Policy Update Sept. 22, 2022

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

Commercial/Multifamily Briefs from Affordable Central Texas, Wells Fargo Foundation, Marcus & Millichap, Project Destined

A new report refutes the misconception that rental apartments priced for the middle-income workforce such as teachers, nurses and first responders have a lower return on investment than apartments with higher rent levels, paving the way for moderate-income rental housing to be a competitive ESG investment.