Institutional Investors Lower Return Expectations

Institutional investors are lowering their real estate return expectations, the Pension Real Estate Association reported.

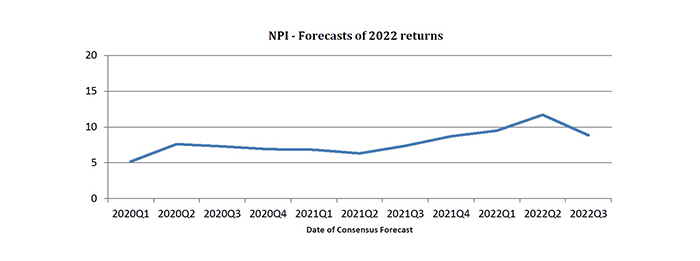

Respondents to a PREA survey said they expect an 8.8 percent total return across property types this year (including income) and 4.4 percent next year. In the same PREA Consensus Forecast Survey six months ago, investors reported they expected a 9.5 percent total return for full-year 2022 and 8.0 percent in 2023.

MBA Vice President of Commercial Real Estate Research Jamie Woodwell said investors continue to work through what recent economic changes will mean for the space, equity and debt markets and how they could affect commercial real estate. “Outlooks continue to vary by property type, especially in terms of what might happen to property values in coming years, with uncertainty around return-to-work for office properties bringing the greatest scrutiny,” he said.

Woodwell noted MBA published a white paper last week, A Framework for Considering Office Demand in a Post-Pandemic World that said the ongoing tug of war between employers and employees about returning to the office will accelerate as pandemic-related impacts fade.

PREA reported investors expect to see a 4.1 percent income return and a 4.7 percent property appreciation return across sectors this year. Next year’s expected total return will likely come mostly from a 4.3 percent income return with just a 0.1 percent appreciation return.

Investors said they expect industrial and multifamily assets to generate the highest returns this year, PREA said. Industrial investors expect a 15.4 percent total return in 2022, made up of a 3.7 percent income return and a 11.8 percent appreciation return. Apartment assets should yield a 9.3 percent full-year return from a 3.8 percent income return and an 5.5 percent appreciation return.

Looking further ahead, PREA said investors expect a 6.1 percent total return in 2024, made up of a 4.4 percent income return and a 1.7 percent appreciation return. The consensus forecast calls for a 6.3 percent total return including income per year between 2022 and 2026, the report said.