The Boulder Group, Wilmette, Ill. said single-tenant net lease property cap rates increased slightly for all three asset classes in the third quarter as debt costs increased.

Category: News and Trends

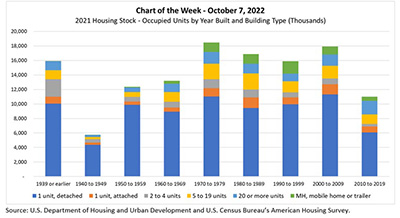

MBA Chart of the Week Oct. 13, 2022: 2021 Housing Stock

At the end of September, HUD and the Census Bureau released 2021 American Housing Survey summary table estimates in the AHS Table Creator and 2021 AHS National and Metro Public Use File microdata. The AHS, last updated with 2019 data, is the “most comprehensive national housing survey in the United States,” and provides information about the quality and cost of housing, including data on “the physical condition of homes and neighborhoods, the costs of financing and maintaining homes, and the characteristics of people who live in these homes.”

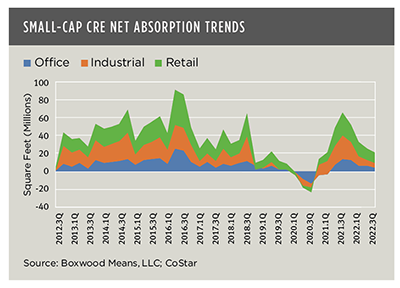

Small-Cap Real Estate Leasing Conditions Waver

Boxwood Means LLC, Stamford, Conn., said current stability of small-cap commercial real estate leasing conditions could be at risk.

Yardi: Reshoring Trend Will Reshape Industrial Real Estate

Recent events have led U.S. firms to produce more goods domestically, which will likely “reshape” the domestic industrial sector, according to Yardi Matrix, Santa Barbara, Calif.

Nomination Deadline Nov. 4: MBA DEI Leadership Commercial/Multifamily Award

Inspire change; share success. The Mortgage Bankers Association recognizes residential and commercial/multifamily members who show leadership in the areas of Diversity, Equity and Inclusion (DEI) internally through market outreach efforts with its annual DEI Leadership Awards.

MBA CREF Policy Update Oct. 13, 2022

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

Commercial and Multifamily People in the News Oct. 13, 2022

Personnel News from CBRE, JLL and Newmark.

Commercial/Multifamily News Briefs Oct. 13, 2022

News in brief from Merchants Capital, Blackstone, Bluerock Capital and Savills.

Quote

“A continuing slowdown in across-the-board leasing velocity reflects mounting concerns among small businesses that economic conditions will get worse before they get better. The Federal Reserve appears hellbent on taming the inflation tiger, and the current regime of interest rate hikes has taken the air out of the proverbial balloon, has raised market risks and may level potentially punishing effects on all commercial real estate market participants.”

–Boxwood Means Principal and Co-Founder Randy Fuchs.

MBA: Commercial/Multifamily Lending Expected to Fall in 2022 Amid Ongoing Economic Uncertainty

The Mortgage Bankers Association, in an updated baseline forecast, said total commercial and multifamily mortgage borrowing and lending is expected to fall to $766 billion this year, down 14 percent from 2021 totals ($891 billion).