NASHVILLE—The Mortgage Bankers Association announced members of its Commercial Real Estate/Multifamily Finance Board of Governors.

Category: News and Trends

MBA Accounting & Financial Management Conference in Phoenix Nov. 8-10

The Mortgage Bankers Association’s annual Accounting and Financial Management Conference takes place Nov. 8-10 at the JW Marriott Phoenix Desert Ridge.

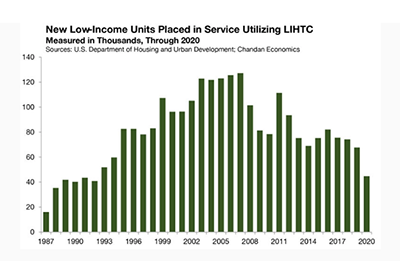

A Critical Juncture for Affordable Housing

The affordable housing market sits at a “critical juncture” as heightened housing demand and soaring inflation challenge low-income households, reported Arbor, Uniondale, N.Y.

STR: Hotel Construction Pipeline Increases for 3rd Month

U.S. hotel construction ticked upward in September for the third consecutive month, reported STR, Hendersonville, Tenn.

MBA Opens Doors Foundation Raises Nearly $184,000 During September Fundraisers

The MBA Opens Doors Foundation raised nearly $184,000 at two successful September fundraisers.

Colliers: Interest Rate Volatility Could Hit Industrial Sector

Industrial sector cap rates have compressed to record lows in recent quarters, but Colliers International, Toronto, reported interest rate volatility has caused some investors to pause new projects and could increase cap rates.

Commercial and Multifamily People in the News Oct. 27, 2022

Personnel News from Bellwether Enterprise, JLL Valuation, Williams Mullen and The CREW Network.

Commercial/Multifamily News Briefs Oct. 27, 2022

News in brief from Freddie Mac Multifamily, Eastdil Secured, Project Destined and Enterprise Community Partners

MBA CREF Policy Update Oct. 27, 2022

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

Don’t Miss MBA #CREF23

Join thousands of your commercial and multifamily real estate colleagues in San Diego for the MBA Commercial/Multifamily Finance Convention & Expo, Feb 12-15, 2023.