The Federal Housing Finance Agency, Washington, D.C., decreased the 2023 multifamily loan purchase caps for Fannie Mae and Freddie Mac slightly to $75 billion each.

Category: News and Trends

Commercial and Multifamily People in the News Nov. 17, 2022

Personnel News from JLL, Quantum Real Estate Advisors and Bellwether Enterprise Real Estate Capital LLC.

MBA CREF Policy Update Nov. 17, 2022

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

Quote

“MBA commends FHFA for its continued commitment to affordable rental housing, including workforce housing, and for providing stable liquidity to the marketplace. We also appreciate FHFA’s flexibility should the caps need to be increased, and its decision to streamline certain mission-driven requirements.”

–MBA President and CEO Bob Broeksmit, CMB, discussing the Federal Housing Finance Agency’s 2023 multifamily loan purchase caps for Fannie Mae and Freddie Mac.

Commercial/Multifamily News Briefs Nov. 17, 2022

News in brief from HUD, Strawberry Fields REIT, Aeon Investments.

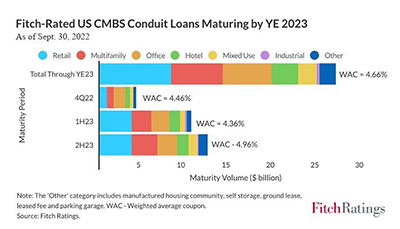

Fitch: Most Maturing CMBS Conduit Loans Can Refinance

Maturing commercial mortgage-backed securities loans have elevated refinancing risk due to rising interest rates and a weakening macroeconomic outlook, reported Fitch Ratings, New York.

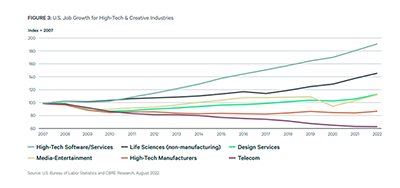

CBRE: Tech Industry Office Leasing Activity Slows, Remains Leading Force

CBRE, Dallas, said the tech industry’s share of U.S. office leasing slipped in first-half 2022 to its lowest figure in five years, though it remains a leading force in the sector.

MBA: 3Q Commercial/Multifamily Borrowing Declines 13 Percent

Commercial and multifamily mortgage loan originations decreased 13 percent in the third quarter from a year ago, according to the Mortgage Bankers Association’s Quarterly Survey of Commercial/Multifamily Mortgage Bankers Originations.

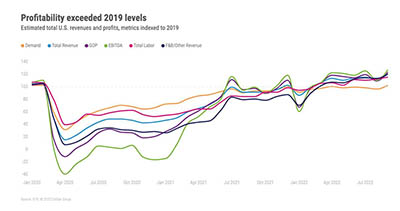

Hotel Profitability Improves, Labor Costs Rise

U.S. hotel gross operating profit per available room improved in September and now exceeds the pre-pandemic comparable, said STR, Hendersonville, Tenn.

Adaptive Reuse Apartments Up 25% from Pre-Pandemic Numbers

Adaptive reuse apartments–other property types converted into apartments–have jumped 25% compared to pre-pandemic levels, reported RentCafe, Santa Barbara, Calif.