Personnel News from JLL, Quantum Real Estate Advisors and Bellwether Enterprise Real Estate Capital LLC.

Category: News and Trends

MBA CREF Policy Update Dec. 1, 2022

Commercial and multifamily developments and activities from MBA relevant to your business and our industry.

#CREF23: Navigating Economic Uncertainty With Roger Ferguson

Economist, corporate executive and finance expert Roger Ferguson will open the MBA Commercial/Multifamily Finance Convention & Expo in February.

Hotel Pipeline Swells

The U.S. hotel pipeline increased 10% year-over-year to 5,317 projects underway as of Sept. 30, reported Lodging Econometrics, Portsmouth, N.H.

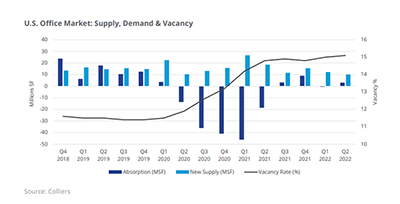

Office Sector’s Future Up for Debate

Colliers International, Toronto, said the U.S. office market is stabilizing following two-plus years of pandemic-driven correction, but noted “considerable debate and speculation” about its future.

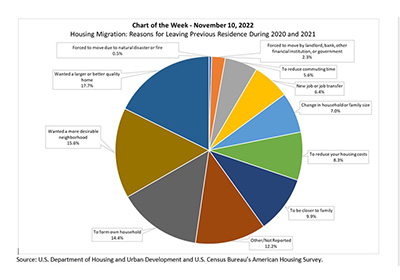

MBA Chart of the Week Nov. 17: Housing Migration

The biennial American Housing Survey, the most comprehensive national housing survey in the United States, provides detailed data on housing migration. These data include responses on the distance of the move, tenure of the respondent’s previous residence and reasons for leaving one’s previous residence.

Dealmaker: JLL Arranges $172M for Four Seasons Hotel Nashville

JLL Capital Markets’ Denver office arranged $172 million in financing for acquisition of the newly completed Four Seasons Hotel Nashville.

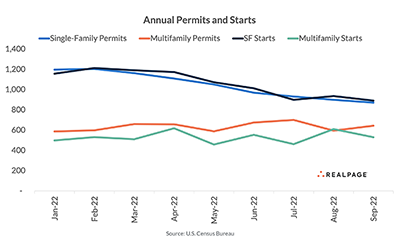

Multifamily Grabs Growing Share of Total Housing

Multifamily building permits and starts have grown since January while single-family permits and starts have dropped, reported RealPage, Richardson, Texas.

3Q Fraud Index Shows Increase in Multifamily Risk

CoreLogic, Irvine, Calif., said its National Mortgage Fraud Risk Index showed little change in the third quarter, although it noted a “significant” increase in risk levels for multifamily purchases.

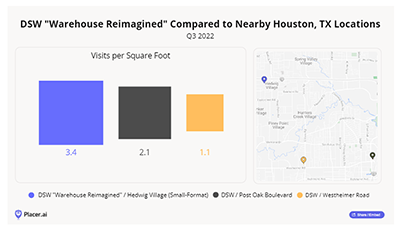

Retail’s Small-Format Advantage

More retailers are now incorporating small-format stores into their portfolios, reported Placer.ai, Los Altos, Calif.