Office Sector’s Future Up for Debate

Colliers International, Toronto, said the U.S. office market is stabilizing following two-plus years of pandemic-driven correction, but noted “considerable debate and speculation” about its future.

“The office sector is facing a set of challenges that could result in significant structural shifts over the years ahead,” Colliers said in U.S. Office Markets: Performance & Prospects.

One significant challenge the sector faces: remote work. Office security firm Kastle Systems, Falls Church, Va., reported many cities have seen increased office occupancy since September and the figure has hovered close to 47% since mid-September. More than half of U.S. office workers visit their office on Wednesdays, but more than two-thirds work telework on Fridays.

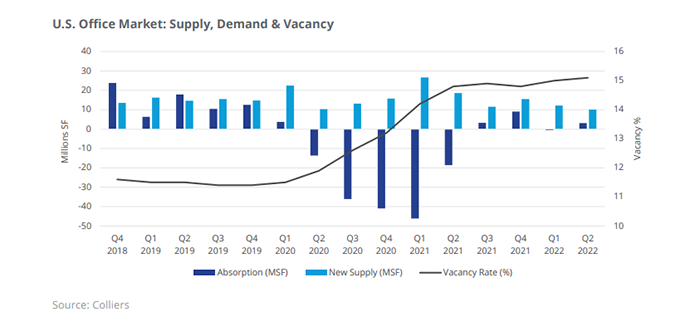

Colliers said the U.S. office vacancy rate equaled 15.1% in the third quarter, a 10 basis point increase over the second quarter. But the report noted vacancy remains still “comfortably below” the 16.3% record peak seen during Great Recession.

“Net absorption remained positive in over half of the office markets tracked in our national survey in the second quarter,” Colliers said. National office absorption, which has been positive in three of the past four quarters, exceeded 3 million square feet, a significant turnaround from the prior four quarters when cumulative net absorption totaled negative 141.8 million square feet.

Office occupiers show a clear preference for the best quality space, Colliers said. Class A absorption totaled 5.6 million square feet during the quarter, while Class B and C combined saw a negative 2.5 million square feet of space absorption.

Eight metros posted 500,000 square feet of positive absorption or more in the second quarter, led by New York City (1.1 million square feet) and Atlanta (one million square feet). Denver, Philadelphia, Phoenix, Raleigh-Durham and San Diego also saw healthy gains, Colliers said.

Other big cities saw significant negative absorption, led by Chicago with -997,000 square feet and Minneapolis with more than half a million square feet of negative absorption.

Colliers said central business district office vacancy reached 15.5%, higher than suburban levels (15%). “This is the first time this has occurred in the history of our data series and can be attributed to a combination of more space being placed on the market in central business district locations which also have a greater share of new deliveries,” the report said.