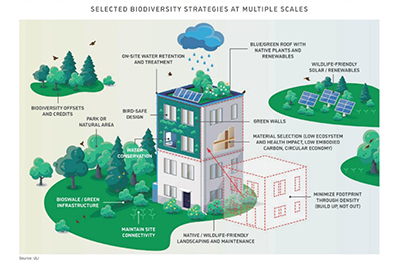

By taking steps to preserve biodiversity, real estate and land use professionals can protect critical natural resources, dramatically reduce carbon emissions, and enhance the value of their properties, according to a report from the Urban Land Institute.

Category: News and Trends

MBA Commercial/Multifamily News Dec. 8, 2022

To read more about upcoming MBA conferences and education, click on the headline.

Top CMF National News Dec. 8, 2022

Here’s a summary of Top National News Items from major news sites and industry trade publications. To get started, click on the headline above.

Quote

“The delinquency rate for mortgages backed by commercial and multifamily properties remained low at the end of the third quarter. For example, the share of bank-held CRE loan balances that were delinquent has only been lower once–just before the onset of the COVID-19 pandemic–in the series’ 30-year history.”

–Jamie Woodwell, MBA Head of Commercial Real Estate Research.

MBA CREF Policy Update Dec. 8, 2022

Commercial and multifamily developments and activities from MBA important to your business and our industry.

Commercial and Multifamily People in the News Dec. 8, 2022

Personnel News from JLL, NewPoint Real Estate Capital LLC.

MBA News Dec. 1, 2022

To read more about upcoming MBA conferences and education, click on the headline.

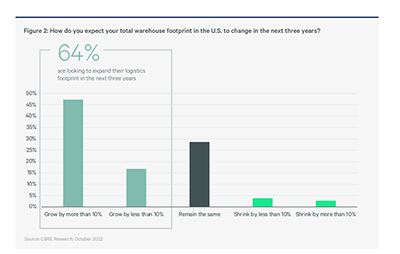

CBRE: Industrial Occupiers Still in Expansion Mode

Strong industrial market demand will likely continue, though not at the record pace set in 2021, said CBRE, Dallas.

Fitch: Commercial mREIT Cash Earnings Supported by Higher Rates

U.S. commercial mortgage real estate investment trusts’ earnings will likely continue to trend modestly higher into 2023 as the sector remains predominantly asset-sensitive, reported Fitch Ratings, New York.

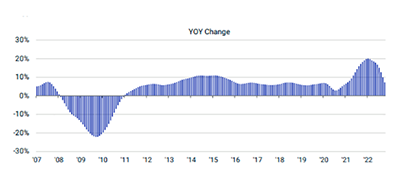

October Commercial Property Prices Fall

Real Capital Analytics, New York, reported U.S. commercial property prices fell in October–though they remain higher than a year ago.