Commercial and multifamily briefs from Yardi Matrix, CoWorking Cafe, CoreLogic and Stronghill Capital.

Category: News and Trends

MBA CMF News and Events Jan. 12, 2023

To read more about upcoming MBA conferences and education, click on the headline.

CMF Quote of the Week

“Real estate markets offer a solid, long-term investment and income stream once pricing levels are clearer…We anticipate investment activity to pick up as central banks end rate hikes and greater economic certainty emerges. In the meantime, investors will remain on the lookout for bargains, with significant funds being drawn up to act.”

—-Tony Horrell, Head of Global Capital Markets with Colliers.

Top CMF National News Jan. 12, 2023

Here’s a summary of Top National News from major news sites and industry trade publications. To get started, click on the headline above.

GSE Leaders Join MBA #CREF23 Speaker Lineup

Join us at MBA’s Commercial/Multifamily Finance Convention & Expo 2023 to hear key leaders, including the Head of Multifamily from both Fannie Mae and Freddie Mac, share their insights on the multifamily finance ecosystem and ongoing policy priorities that shape the way forward for our industry and communities.

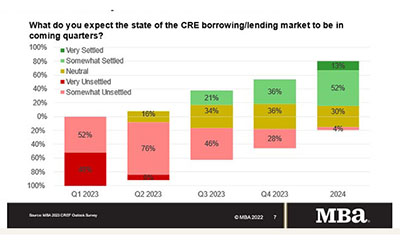

MBA CREF Outlook Survey: Unsettled Markets to Dissipate in 2023

Commercial and multifamily mortgage originators are experiencing an unsettled market for borrowing and lending but anticipate those conditions will slowly stabilize over the course of this year, the Mortgage Bankers Association’s 2023 Commercial Real Estate Finance Outlook Survey found.

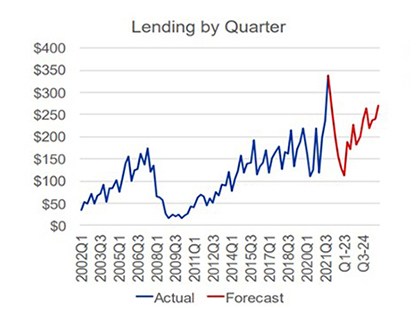

MBA: 2023 Commercial, Multifamily Borrowing/Lending Expected to Fall to $700B

The Mortgage Bankers Association released its updated baseline forecast Thursday, projecting total commercial and multifamily mortgage borrowing and lending to fall to $700 billion this year, a 5 percent decline from an expected 2022 total of $740 billion.

Fannie Mae, Freddie Mac Announce Replacement Rates for Legacy LIBOR Products

Fannie Mae and Freddie Mac announced replacement rates for legacy LIBOR loans and securities.

CMBS Supply-Demand Fundamentals Slip

Commercial property market supply and demand fundamentals slipped in the third quarter, reported Moody’s Investors Service, New York.

Yardi: E-Commerce Propelling Industrial Sector

The e-commerce boom that started in 2020 is still propelling the U.S. industrial market, reported Yardi Matrix, Santa Barbara, Calif.