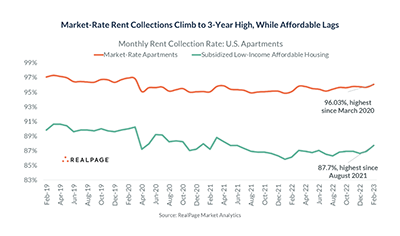

RealPage, Richardson, Texas, reported market-rate apartment renters are paying their monthly rent at the highest frequency in three years.

Category: News and Trends

MBA CREF Policy Update March 16, 2023

Commercial and multifamily developments and activities from MBA important to your business and our industry.

Commercial/Multifamily Briefs, March 16, 2023

Commercial and Multifamily Briefs from KBRA and Green Street.

CMF Quote of the Week: March 16, 2023

“MBA and its members are committed to expanding affordable rental housing opportunities for minorities and communities of color. The Council is instrumental in developing strategies and recommendations that will assist MBA in creating effective and equitable solutions to address our nation’s affordable rental housing crisis.”

–MBA President and CEO Bob Broeksmit, CMB, discussing MBA’s 2023 Affordable Rental Housing Advisory Council.

Commercial and Multifamily People in the News March 16, 2023

Personnel News from Northmarq, nxtCRE and Greystone.

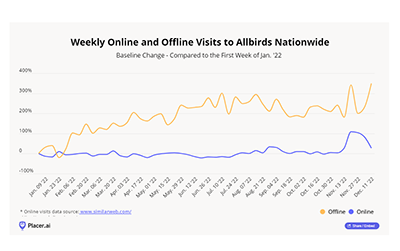

Digitally Native Brands Look to Brick and Mortar

Placer.ai, Los Altos, Calif., said a robust brick-and-mortar operation is critical for digitally native brands looking to build brand awareness, streamline distribution and drive consumer engagement.

Trepp: 2022 Life Insurance Mortgage Returns Worse Than 2008

Trepp LLC, New York, said its life LifeComps index of insurance company commercial mortgage investments saw a -10.1% return in 2022, largely due to a -14.3% appreciation return.

Lenders Active in Hotel Sector

Lenders remain active in the hotel sector despite rising interest rates, inflation and recessionary fears, reported real estate investment banking firm RobertDouglas, New York.

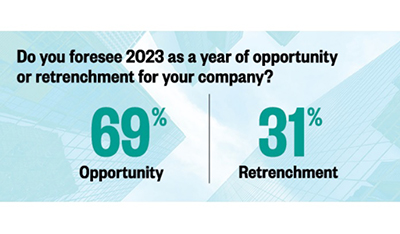

Survey Finds CRE Executives Remain Optimistic

More than two-thirds of commercial real estate executives maintain a positive outlook despite the highest interest rate environment since 2007 and a looming recession, reported law firm Seyfarth Shaw LLP, Chicago.

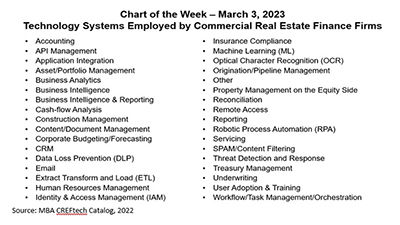

MBA Chart of the Week: Tech Systems Employed by Commercial Real Estate Finance Firms

Lenders closed $800 billion in mortgages backed by income-producing commercial and multifamily properties in 2022–adding to what is now almost $4.4 trillion in outstanding loans.