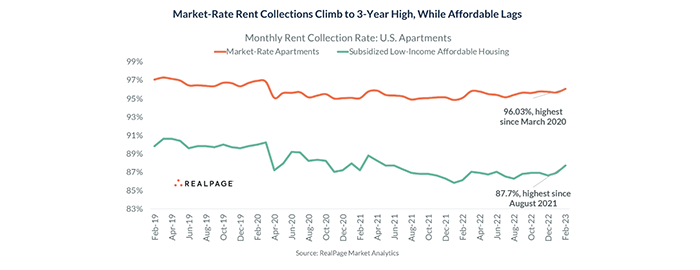

RealPage: Apartment Rent Collections Reach Highest Mark Since Before COVID

RealPage, Richardson, Texas, reported market-rate apartment renters are paying their monthly rent at the highest frequency in three years.

Rent collections climbed to 96.03% in February, the highest rate since March 2020, RealPage said in a new report.

“Improving rent payments provide further evidence that market-rate renters are generally in stronger financial shape than widely believed,” said Jay Parsons, Vice President and Head of Economics with RealPage. “Of course, exceptions continue to exist–as they always have, even pre-COVID–and therefore the strong results do not negate the need for more affordable housing supply and rental assistance programs.”

RealPage noted rent collections routinely topped 96% prior to the pandemic, then dropped to 95.1% in April 2020 and later fell as low as 94.9%. The February result marked a 0.3 percentage point improvement since January and a 0.9 percentage point improvement year-over-year.

“The fact that the vast majority of renters continued to pay rent through COVID and the inflationary period that followed helps explain why eviction filings never spiked as much as some feared,” Parsons said. He noted improving rent payments align with broader consumer trends. “Earlier this year, Bank of America reported that consumers were in solid financial shape due to wage gains and to stimulus spending, even despite inflation at 40-year highs,” he said.

RealPage said renters in the most expensive Class A apartments pay rent at the highest rate, with collections measuring 97.6% in February. These renters also tend to have the highest incomes. Collections measured 96.8% in Class B and 94.9% in Class C.

“Cooling rent growth should provide a further tailwind for renters’ ability to pay rent,” Parsons said. Year-over-year effecting asking rent growth for new lease signers in market-rate apartments has cooled from 15.7% in March 2022 to 4.5% in February 2023. “However, the outlook could change if job losses–which so far have been primarily limited to high-income jobs in the tech sector–extend more broadly,” he said.