Commercial/Multifamily people news from Berkadia, Northmarq, Marcus & Millichap and JLL.

Category: News and Trends

CBRE: Multifamily Market Continues to Stabilize

CBRE, Dallas, found the multifamily market showed signs of stabilization in the second quarter.

Dealmaker: Bandon Capital Advisors Secures Two Refinancing Transactions Near SoFi Stadium

Bandon Capital Advisors, Los Angeles, announced it arranged two refinancing transactions totaling $24.55 million for properties in Inglewood, Calif., across from the new NFL SoFi Stadium.

CMF Quote of the Week: Aug. 10, 2023

“Midway through the year, we are starting to see a return to more normal patterns, although performance is a bit weaker.”

–Sara Hoffmann, director of multifamily research at Freddie Mac–MBA Head of Commercial Real Estate Research Jamie Woodwell.

MBA Opposes Proposed Rulemaking Implementing Basel III Endgame and Making Changes to Capital Requirements for Banks

The Mortgage Bankers Association strongly urged federal policymakers to vote against a proposed Notice of Proposed Rulemaking implementing the Basel III “endgame” rule, which is set for consideration on July 27.

The rule is expected to impose a 15 to 20 percent increase in capital requirements for larger institutions.

Commercial/Multifamily People in the News July 27, 2023

Commercial/Multifamily People in the News from Greystone and NewPoint Real Estate Capital.

Dealmaker: Slate Asset Management Closes $27M Senior Loan Facility for Oakland Multifamily Property

Slate Asset Management, Toronto, announced its unit Slate Real Estate Capital closed a $27 million senior loan facility provided to a private investor for the financing of Lantana Uptown, a multifamily residential property in Oakland, Calif.

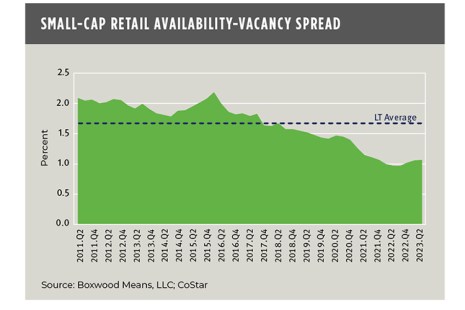

Boxwood Means Finds Promising Results for Small-Cap Retail in Q2

Boxwood Means, Stamford, Conn., found small-cap retail in Q2 flourished, per an analysis of CoStar occupancy data involving small retail buildings under 50,000 square feet.

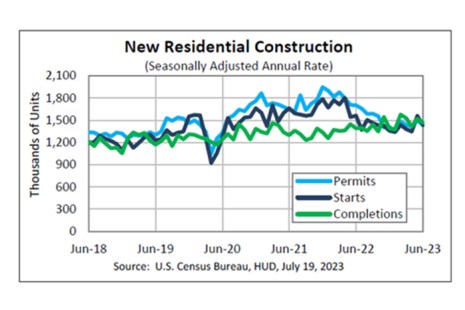

Housing Starts Down in June

Housing starts fell by 8% from May to June, the Census Bureau and Department of Housing and Urban Development jointly reported Wednesday. June’s starts were at a seasonally adjusted annual rate of 1,434,000, compared with May’s revised 1,559,000.

Fitch: Life Insurers Well Positioned to Withstand Commercial Real Estate Exposure Risks

Fitch Ratings, New York, said the life insurance companies it has rated are well positioned to withstand the mounting challenges from rising losses and falling commercial real estate valuations.