Commercial and multifamily developments and activities from MBA important to your business and our industry.

Category: News and Trends

Support the Next Generation of CREF Professionals

The Commercial Real Estate Finance Careers Student Fellowship program provides college students, including those from groups traditionally underrepresented in the industry, with a package of networking and educational opportunities centered on the $4.5 trillion commercial real estate finance industry.

CMF Quote of the Week: Sept. 7, 2023

“Housing choice vouchers are some of the strongest tools we have to help families find stable and affordable housing.”

–HUD Secretary Marcia L. Fudge

MISMO Seeks Public Comment on ESG Reference Material

MISMO, the real estate finance industry’s standards organization, today announced that it is seeking public comment on the new Defining the E and S Reference Guide and the related Data Implementation Considerations Guide.

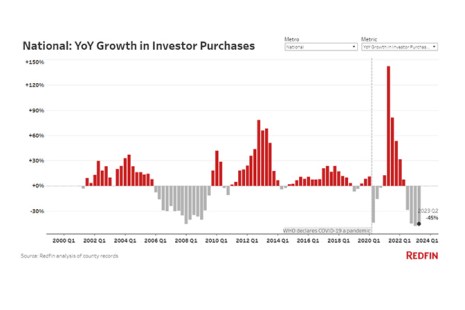

Real Estate Investors Buying 45% Fewer Homes Than Last Year, Redfin Finds

Redfin, Seattle, reported that the drop in home purchases by investors outpaced the second-quarter drop in overall home sales. Investor home purchases fell 45% from last year, compared with an overall market drop of 31%.

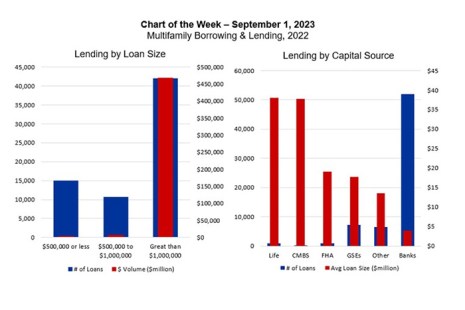

MBA Chart of the Week: Multifamily Borrowing and Lending, 2022

With more than $4.5 trillion of mortgage debt outstanding, commercial real estate finance markets are large and diverse.

HUD Updates Fair Market Rents; Releases $113M in Vouchers

HUD on Thursday published Fair Market Rents for Fiscal Year 2024 and released an additional $113 million in Housing Choice Vouchers to help 9,500 families to meet growing costs.

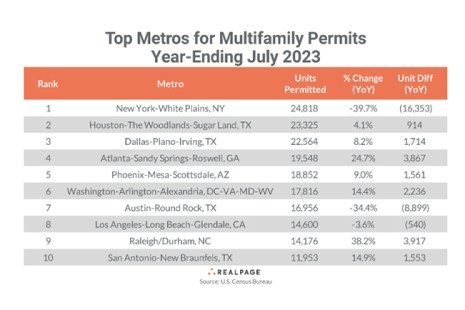

Multifamily Permitting Falls, RealPage Analytics Notes

RealPage Analytics, Richardson, Texas, reported the seasonally adjusted annual rate for multifamily permitting fell 32.2% year-over-year in July, per an analysis of Census Bureau data.

Share Your Winning DEI Strategies: Deadline Nov. 3

Join the ranks of other MBA commercial/multifamily member companies and share how your organization has gone above and beyond to cultivate a diverse and inclusive environment. Don’t miss the opportunity to share what makes your DEI strategy one to be recognized.

Dealmaker: Cushman & Wakefield Arranges Sale, $97.7M Acquisition Financing Provided by Greystone

Cushman & Wakefield, Chicago, announced it arranged the sale of a multifamily property in Wayne, N.J., a New York-area suburb.