MBA Chart of the Week: Multifamily Borrowing and Lending, 2022

(Image courtesy MBA Annual Report on Multifamily Lending)

With more than $4.5 trillion of mortgage debt outstanding, commercial real estate finance markets are large and diverse. Much of the attention lately has been on the office sector, which accounts for $750 billion of that total. But a recent MBA report detailing lending activity supporting the nearly $2 trillion of multifamily mortgage debt outstanding provides key insights into the different roles played by different capital sources, and in particular how the bank sector is unlike many of the other lending sources.

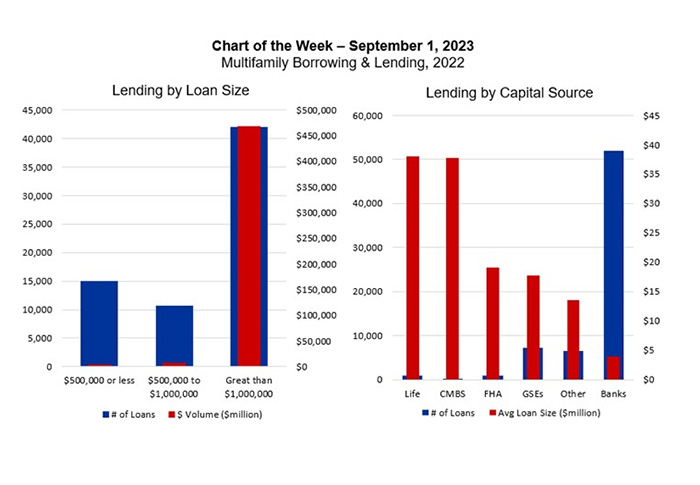

Every year, MBA’s Annual Report on Multifamily Lending details borrowing and lending activity backed by multifamily properties – in 2022 totaling $480 billion across 67,191 loans made by 2,242 lenders. The report tracks each lender, their total loan activity (by dollar and count) and their average loan size.

More than one-third of the multifamily loans that were made last year were for less than $1 million. Almost one-quarter were for less than $500,000. These loans are largely the domain of the banks. The average size of a multifamily loan made for a bank portfolio was $3.9 million, compared to averages of $38 million for life companies and CMBS, $19 million for FHA and $18 million for Fannie Mae or Freddie Mac. The bank lending accounted for 77 percent of the loans (51,931 of the total 67,191) but just 42 percent of the dollar volume ($201 billion out of $480 billion).

In the current discussions about the impacts of CRE on banks, or of banks on CRE, it is important to note that the majority of loans made by the majority of lenders, particularly bank lenders, are not those that made the news headlines earlier this year. They are instead small loans backed by small properties, often owned by a local entrepreneur, and they are one of only a few multifamily loans that the lender made during the year. (One-third of active multifamily lenders made 5 or fewer multifamily loans in 2022.)

The multifamily lending market – like the apartment market itself and CRE more broadly – is large and diverse, with different types of lenders playing in different parts of the market.