“Not unexpectedly, delinquency rates on commercial mortgages increased for the third consecutive quarter,”

–Jamie Woodwell, MBA’s Head of Commercial Real Estate Research

“Not unexpectedly, delinquency rates on commercial mortgages increased for the third consecutive quarter,”

–Jamie Woodwell, MBA’s Head of Commercial Real Estate Research

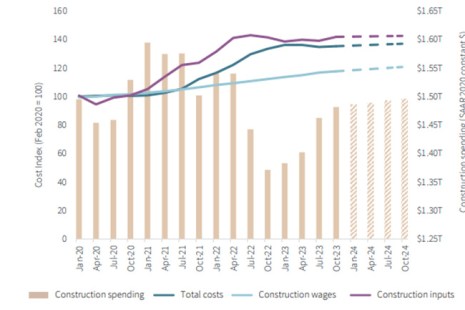

JLL, Chicago, released its U.S. and Canada Construction Trends 2024 forecast, positing that the industry will have a positive 2024, but also acknowledging existing challenges.

Fitch Ratings, New York, shifted its sector outlook for the U.S. title insurance market to neutral for 2024.

These can be challenging times for commercial real estate borrowers facing tight credit markets. It’s also stressful for banks who want to help their clients but are limited in what they can do. Enter C-PACE.

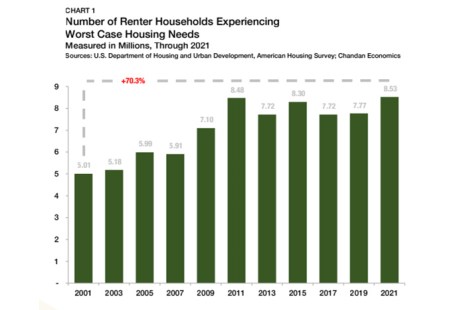

Arbor Realty Trust, Uniondale, N.Y., released its Affordable Housing Trends Report for Fall 2023, finding that utilization of the 4% Low-Income Housing Tax Credit has reached a new high, among other notable takeaways.

CBRE, Dallas, is forecasting a recovery in revenue per available room growth for hotels in 2024.

Commercial and multifamily developments and activities from MBA important to your business and our industry.

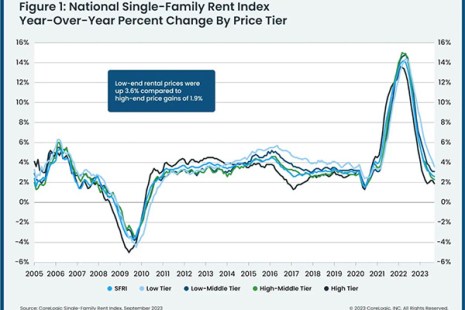

CoreLogic, Irvine, Calif., found annual single-family rent growth dropped to the lowest point in three years in September with a 2.6% year-over-year increase.

STR and Tourism Economics lifted their year-over-year growth projections for hotel average daily rates and revenue per available room in their final hotel forecast revision of 2023.

“Single-family rent growth eased again in September and is now back to the rate recorded before the pandemic.”

–Molly Boesel, Principal Economist for CoreLogic