STR, TE Upgrade Hotel Average Daily Rate, Revenue Forecast

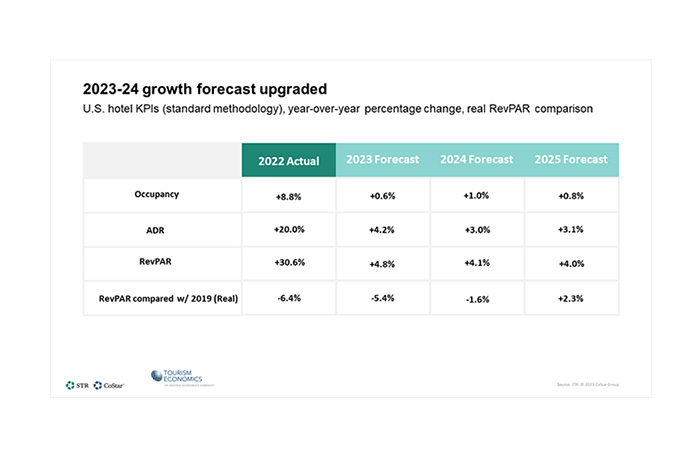

(Chart courtesy of STR and Tourism Economics)

STR and Tourism Economics lifted their year-over-year growth projections for hotel average daily rates and revenue per available room in their final hotel forecast revision of 2023.

For 2023, the analysts increased their RevPAR growth forecast by 0.3 percentage points, due to a 0.6 percentage points lift in ADR growth. “Recent RevPAR trends demonstrate that rate continues to be the primary driver of performance,” the report said. The hotel occupancy forecast was downgraded slightly, by 0.2 percentage points.

For 2024, the growth projections for each of the key performance metrics remained flat from the previous forecast due to the above long-term average trends beginning to stabilize.

“Our latest projections reflect the continued buoyancy of travelers, as room rates outperformed our previous forecast, which built in a mild recession,” STR President Amanda Hite said. “As a result, we have raised RevPAR for the remainder of 2023, with risks on the upside.”

Looking ahead to the new year, Hite said she expects to see continued growth in RevPAR. “The latest economic outlook calls for a stalling economy with growth well below the levels seen toward the end of the pandemic,” she said. “Despite the potential dip, we see strong traveler fundamentals, including low unemployment among college-educated individuals, an increased volume of households above $100,000 in income, a rise in real personal disposable income and a somewhat stable corporate environment. The projected increase in ADR will result in higher Total RevPAR, which combined with less spend on labor, lifts our expectation for GOP as well. The gap in hospitality employment levels coupled with increased operational efficiencies brought down our labor cost forecast.”

Tourism Economics Director of Industry Studies Aran Ryan said decelerating factors including higher interest rates, more restrictive lending, tighter fiscal policy and weakened household finances could lead consumers to rein in spending and firms to cut back on hiring and investment, likely causing the economy to flirt with recession. “[But] travel sector improvements, including stronger group activity and returning international visitors, will help offset economic factors, supporting still-solid RevPAR gains,” he said.