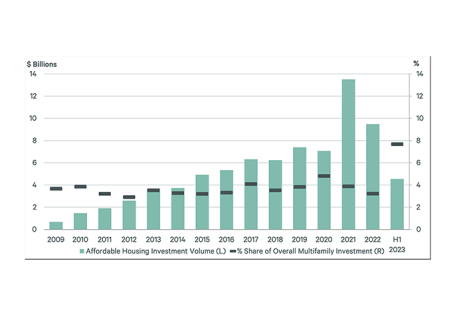

CBRE, Dallas, found affordable housing investment trends over the past few years have tracked some aspects of the overall multifamily market.

Category: News and Trends

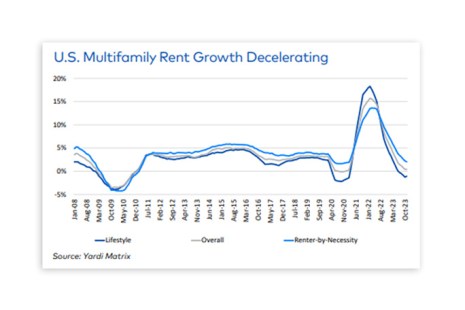

Yardi Matrix: 2024 Multifamily Outlook Mixed

Yardi Matrix, Santa Barbara, Calif., released an outlook for the multifamily market in 2024, pointing to expectations as “mixed.”

CREF Policy Update Jan. 4: FDIC (Re)Advises Caution for Banks With Large CRE Concentrations

Commercial and multifamily developments and activities from MBA important to your business and our industry.

CMF Quote of the Week: Jan. 4, 2024

“Questions about some properties’ fundamentals, about where property values sit, and about where interest rates may go from here have led to many participants sitting on the sidelines—waiting for greater clarity and perhaps more favorable conditions.”

–From the MBA Commercial/Multifamily Quarterly DataBook

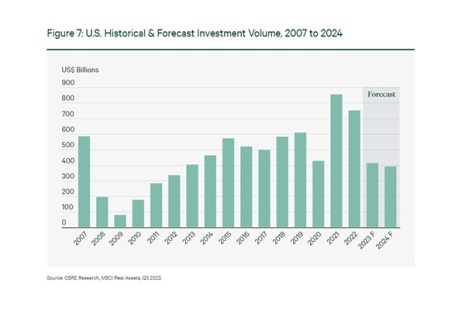

CBRE Predicts Likely Upturn in Commercial Real Estate Investment in Second-Half 2024

CBRE, Dallas, released its U.S. Real Estate Market Outlook 2024, predicting that commercial real estate investment activity likely will begin to pick up in the second half of next year.

Speaker Spotlight: FHFA’s Sandra Thompson at CREF24

Federal Housing Finance Agency Director Sandra Thompson will speak at a General Session on Multifamily at CREF24 on Feb. 12, from 10:30 am-11:00 am (PST).

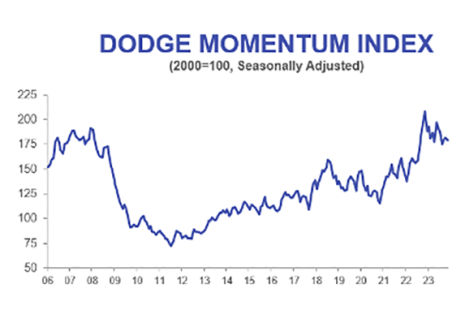

Dodge Momentum Index Decreases 1% in November

The Dodge Momentum Index decreased 1% in November to 179.2 (2000=100) from the revised October reading of 181.7, according to the Dodge Construction Network, Hamilton, N.J.

Freddie Mac Apartment Investment Market Index Posts Slight YoY Increase

Freddie Mac Multifamily reported its Apartment Investment Market Index ticked downward in the third quarter but is up 0.3% over the past 12 months.

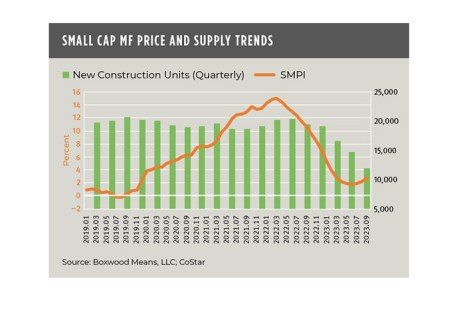

Boxwood Means: Small Cap Multifamily Properties Stay Positive

Boxwood Means, Stamford, Conn., found prices for small cap multifamily properties have remained positive despite headwinds for the larger sector.

Dealmaker: M&T Realty Capital Corp. Provides $11M Loan for Bronx Property

M&T Realty Capital Corp., Baltimore, provided a $10.5 million permanent loan to refinance a newly stabilized multifamily rental property in Bronx, N.Y.