Boxwood Means: Small Cap Multifamily Properties Stay Positive

(Image courtesy of Boxwood Means)

Boxwood Means, Stamford, Conn., found prices for small cap multifamily properties have remained positive despite headwinds for the larger sector.

The Q3 national vacancy rate for small multifamily rentals was 4.7%, 50 basis points higher than a year earlier, but still below its long-term average. That compares, however, with the overall national vacancy rate of 7.4%, per an analysis of CoStar data.

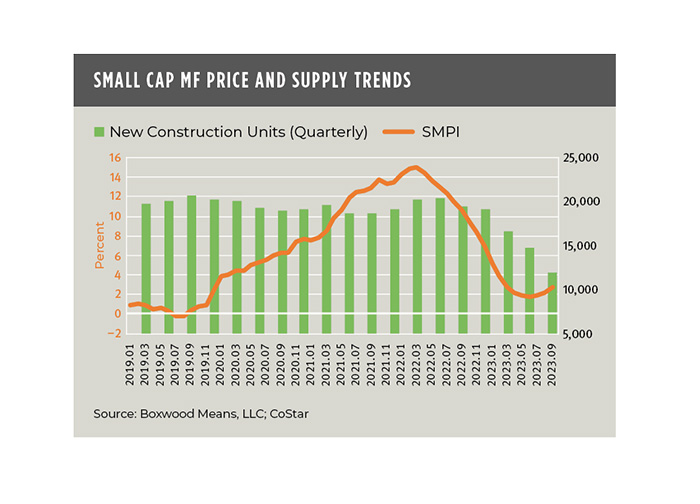

While small cap tenant demand may be flagging, along with a 1.7% annual effective rental growth rate, there aren’t a ton of new small cap multifamily buildings coming online either.

A rolling four-quarter average of 12,000-13,000 units delivered is a very small fraction of the apartment market, with similar weakness in the construction pipeline.

Those factors combined show a significantly different environment for small cap multifamily properties, noted Randy Fuchs, Boxwood Means Principal and Co-Founder.

“In contrast with RCA’s low-teens price decline for the apartment market at large, Boxwood’s Small Multifamily Price Index gained 2.7% over 12 months through September, a noteworthy, albeit modest result in light of market-wide commercial real estate headwinds,” Fuchs wrote. “Moreover, SMPI has produced 3- and 5-year returns of 28.4% and 36.9%, respectively, that have soundly outperformed RCA’s Apartment CPPI over the same time periods and, with its 111.3% gain over 10 years, SMPI nearly competes with the latter’s longer-term price growth as well.”