House Approves $2 Trillion Stimulus Bill; Trump Signs into Law

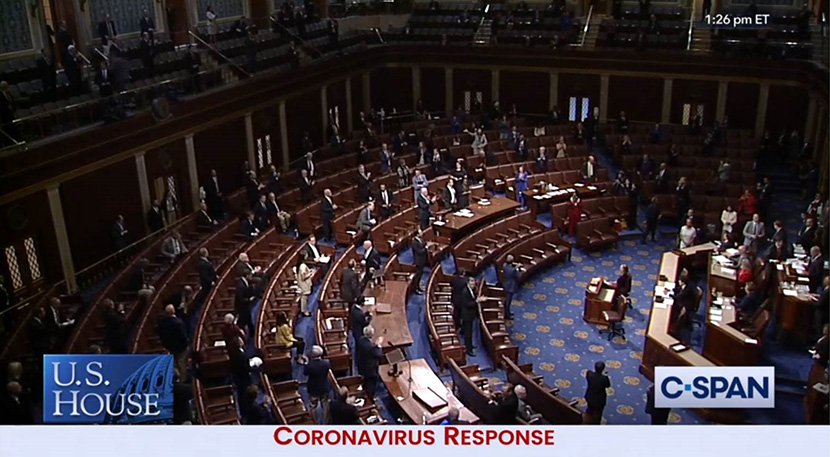

The House on Friday approved a massive $2 trillion stimulus bill aimed at injecting a much-needed boost to a U.S. economy that has been staggered by the coronavirus pandemic.

By a voice vote, the House approved the Coronavirus Aid, Relief and Economic Security Act, also known as the CARES Act. The 800-plus page bill had been approved by the Senate by a 96-0 vote earlier in the week. President Trump signed the bill into law on Friday afternoon.

Mortgage Bankers Association President and CEO Bob Broeksmit, CMB, released this statement following the bill’s passage:

“MBA commends the House for passing this important piece of legislation that will help the millions of Americans who are impacted by COVID-19. We recognize the hardships that many are facing, and we are hopeful that this legislation will provide critical assistance to those in need.

“It is also encouraging to see policymakers recognize the importance of including funding that can be leveraged to create a broad, dedicated Federal Reserve liquidity facility. With the passage of the CARES Act, we continue to urge the Federal Reserve and U.S. Treasury to create a financing program to help any residential and commercial/multifamily mortgage servicer who will need assistance in order to provide unprecedented levels of mortgage payment forbearance required under the legislation to help families with COVID-19-related hardships.

“On behalf of the real estate finance industry, we look forward to continuing to work with the administration, Congress, the Fed, and state and local officials to ensure that borrowers, renters, and small businesses are properly supported and protected during this pandemic.”

The bill includes the following provisions of interest to the real estate finance industry:

Liquidity Facility: $454 billion for loans, loan guarantees, and investments in programs or facilities established by the Federal Reserve for the purposes of providing liquidity to the financial system that supports lending to eligible businesses, states, or municipalities. This funding would enable Treasury and the Fed to establish a liquidity facility for loan servicers to access for advancing payments, and we continue to press hard on all fronts for a speedy announcement of such a facility.

Consumer Right to Request Forbearance: Applies to federally backed mortgage loans (Fannie Mae/Freddie Mac/FHA/VA/USDA) for those directly or indirectly impacted by the COVID-19 virus (if the borrower requests and affirms hardship). No signature or documentation is required, and the initial period is up to 180 days initially, with the option to extend for up to an additional 180 days. This broadly mimics the programs Fannie Mae and Freddie Mac have already announced.

Multifamily Mortgage Forbearance: A total of 90 days of forbearance (30-day forbearance on initial request, extendable for two additional 30-day periods), which applies to federally insured, guaranteed, supplemented, or assisted mortgages, including mortgages purchased or securitized by the GSEs.

Moratorium on Evictions: For 120 days after date of enactment, applies to single-family and multifamily properties that participate in federal housing, homelessness, rural programs, or properties financed by federally insured, guaranteed, supplemented or assisted mortgages, including mortgages purchased or securitized by the GSEs.

Small-Business Assistance: $349 billion for SBA loans to help small businesses make payroll and pay rent and mortgage payments, with loans of up to $10 million. Proceeds may be used for payroll, rent, payment of mortgage interest (not principal) and utilities.

HUD Rental Assistance

- $5 billion for Community Development Block Grants

- $4 billion in homelessness assistance

- $1.25 billion in tenant-based assistance

- $1 billion in project-based assistance

- $50 million for housing for the elderly

- $15 million for housing for persons with disabilities

Temporary Lending Limit Waiver: Nonbank financial companies temporarily included in OCC’s lending limits waiver.

CECL: Option to temporarily delay Current Expected Credit Losses application. Applies to insured depositories (including credit unions).

Troubled Debt Restructurings: Financial institution may elect to suspend TDR determination under GAAP for COVID-19-related loan modification.

Community Bank Leverage Ratio: Agencies to temporarily reduce the CBLR for qualifying community. banks from 9 percent to 8 percent

Debt Guarantee Authority: FDIC authorized to temporarily establish a debt guarantee program to guarantee debt of solvent insured depositories and depository institution holding companies.