MBA Chart of the Week: Treasury Yield Spreads

Source: Federal Reserve.

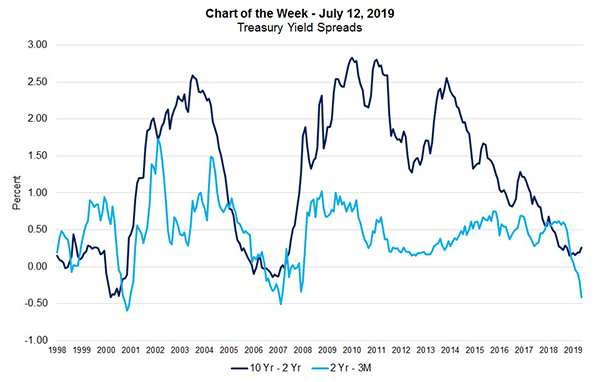

Our chart this week is an update of two closely tracked Treasury spreads, both of which have dropped in recent months.

An inverted yield curve is seen by many as the precursor to a recession, as it indicates that investors see a sharp slowdown in growth ahead. The last time spreads were this narrow were before and during the Great Recession. As signs of a broader global slowdown in economic growth emerge, along with ongoing trade disputes between the US and some of its key trading partners, business and consumer confidence have been shaken, which has pushed many investors to safer assets such as US Treasuries.

Markets have shifted their expectations from the Fed raising rates to the Fed cutting rates, and in most recent communication many Fed officials have acknowledged that rate cuts might now be necessary even though unemployment is low and the economy is still growing.

As shown in the chart, the spread between the 10- and 2-year has averaged around 120 basis points since 1998, with the 10-year rate typically higher than the 2-year rate as investors are compensated for the higher risk of holding a longer term bond. Over the past two years, this spread has dropped below its average and as of June 2019, stood at around 20 basis points. The spread between the 2-year and 3-month bonds averaged around 50 basis points for the charted period until narrowing sharply in December 2018 and going negative, or inverting, in March 2019 through June 2019.

This inversion is a clear signal that a further economic slowdown is likely. The question is whether growth will slow to a halt in early 2020, per our forecast, or whether the economy will enter a recession.

With these developments in financial markets, mortgage rates have moved lower in recent months and hit 2017 lows. This has triggered a reemergence of refinance activity and helped push purchase activity higher than it was in 2018.

(Mike Fratantoni is chief economist and senior vice president of research and economics with the Mortgage Bankers Association. He can be reached at mfratantoni@mba.org. Joel Kan is associate vice president of economic and industry forecasting with MBA; he can be reached at jkan@mba.org.)