Chart of the Week: Private Job Openings, Hires and Quits

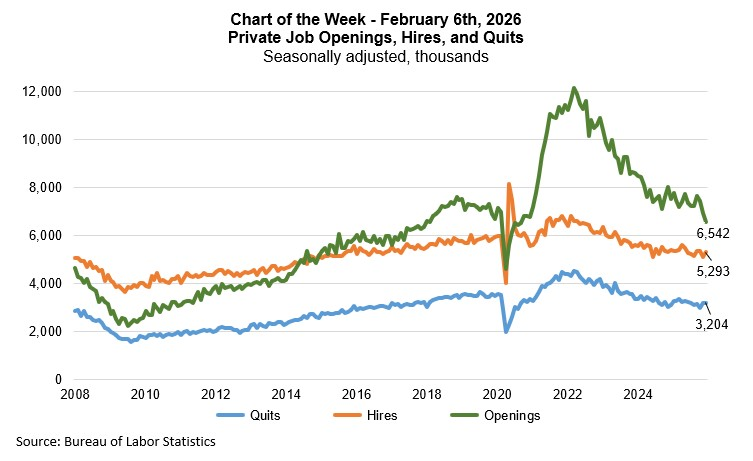

December’s Job Openings and Labor Turnover Survey (JOLTS) results continued to indicate a soft job market with employers reducing open positions and hiring at a cautious pace, and workers are still voluntarily leaving their jobs at a slower rate. A low level of quits usually implies that workers are less confident about finding new or better jobs elsewhere, so they choose to remain in their current jobs. The number of job openings dropped to 6.5 million, the lowest level since 2018, when excluding the 2020-2021 pandemic-impacted periods. The sectors with the largest pullbacks in job openings were professional and business services, retail trade, and finance and insurance.

The number of hires was below 5.3 million, consistent with fewer jobs added to the economy in 2025 and with only about half of industry sectors seeing job growth, according to the Employment Situation report released last month.

Another metric calculated from the JOLTS data, showing how much tougher the job market has become, was the number of open positions available per unemployed worker, which was 0.9 in December, down from a peak of 2 openings in 2022.

In considering the various data on employment, we expect further weakening, with the unemployment rate forecast to reach 4.6% in the first half of 2026, from its current level of 4.4%. This is likely to have a slight drag on home purchase activity in the months ahead, but will also contribute to further deterioration in mortgage loan performance, which tends to be closely correlated to the health of the job market. In particular, FHA delinquencies have been elevated since late 2023, as FHA borrowers are most susceptible to higher prices and job or income loss. National Delinquency Survey results for the fourth quarter of 2025 are scheduled to be released next week.