ICE Mortgage Monitor Finds Some Early Signs of Stress for Homeowners

ICE Mortgage Technology, Atlanta, released its July 2025 Mortgage Monitor report, finding that there are early signs of financial stress emerging among subsets of homeowners.

MBA’s Bob Broeksmit on the Numerous Real Estate Wins in Tax Package, Latest on Credit Reporting Costs

The Mortgage Bankers Association’s President and CEO Bob Broeksmit, CMB, released a video July 7 highlighting the pro-housing wins secured in the Republican-led tax and reconciliation that was passed last week and then signed into law by President Donald Trump.

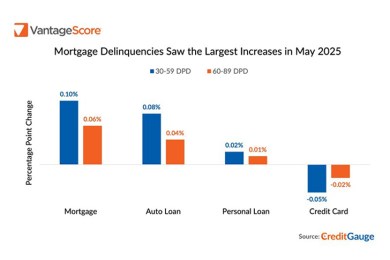

VantageScore: May Mortgage Delinquencies Increase the Most Among Credit Products

Mortgage loans led an increase in early- and mid-stage delinquencies across all credit categories in May, according to new CreditGauge report from VantageScore, San Francisco, Calif.

Economy Adds 147,000 Jobs in June; Industry Economists Weigh In

Total nonfarm payroll increased by 147,000 in June, and the unemployment rate was 4.1%, the U.S. Bureau of Labor Statistics announced.

ATTOM: Home Affordability Continues to Weaken Across Country

ATTOM, Irvine, Calif., released its U.S. Home Affordability Report for Q2, finding that in 99% of counties analyzed, median-priced single-family homes and condos were less affordable than historical averages.

Zillow Finds Buyers Need $17,000 Raise to Afford a Home

Five years ago, a median-income household could afford a typical U.S. home. Today, they’re more than $17,000 short, even if they have $73,000 saved for a down payment, a new Zillow analysis found.