Case-Shiller Index Up 3.9% in February

(Image courtesy of S&P Dow Jones Indices; Breakout image courtesy of Curtis Adams/pexels.com)

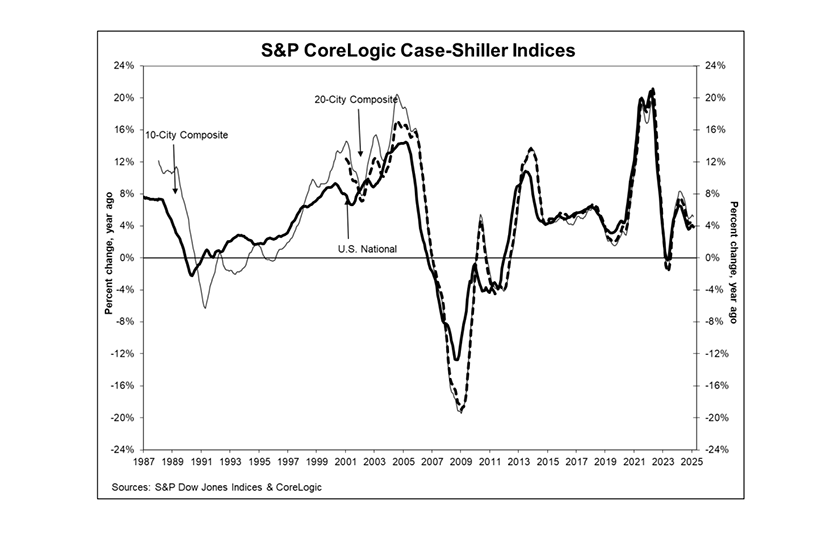

The S&P CoreLogic Case-Shiller Indices found a 3.9% annual gain in February, down from an annual gain of 4.1% in January.

“Even with mortgage rates remaining in the mid-6% range and affordability challenges lingering, home prices have shown notable resilience,” said Nicholas Godec, Head of Fixed Income Tradables & Commodities at S&P Dow Jones Indices. “Buyer demand has certainly cooled compared to the frenzied pace of prior years, but limited housing supply continues to underpin prices in most markets. Rather than broad declines, we are seeing a slower, more sustainable pace of price growth.”

On a month-over-month basis, the U.S. National Composite was up 0.4% from January (before seasonal adjustment) or 0.3% (after seasonal adjustment).

The 10-city composite saw an annual increase of 5.2%, compared with a 5.4% annual increase in January. And, the 20-city composite saw an annual increase of 4.5%, compared with 4.7% in January.

New York had the highest annual gain among the spots included in the 20-city composite, up 7.7% year-over-year, followed by Chicago (up 7%) and Cleveland (up 6.6%).

Tampa, Fla., saw the lowest return, falling by 1.5% year-over-year.