ICE First Look: Delinquencies Creep Up in February

Intercontinental Exchange Inc., released its “first look” at February mortgage performance, finding the national delinquency rate edged up five basis points to 3.53% in February.

CoreLogic: Average Homeowner With Mortgage Gained $4,100 in Equity in 2024

CoreLogic, Irvine, Calif., released its Homeowner Equity Report for the fourth quarter of 2024, finding that nationwide, borrower equity increased by $281.9 billion. That’s an increase of 1.7% year-over-year.

Harvard JCHS: Remodeling Soars to New Heights

The U.S. remodeling market soared above $600 billion after the pandemic and remains 50% above pre-pandemic levels despite recent softening, the Harvard Joint Center for Housing Studies reported.

Zillow: Homes at Risk of Climate Disaster Total Trillions

Zillow, Seattle, released a study analyzing the value of U.S. homes at major risk of damage from fire, flood or extreme wind.

Home Flipping Declines Again, ATTOM Finds

Nearly 298,000 single-family homes and condos in the United States were flipped last year, down 7.7% from 2023 and 32.4% from the recent peak of nearly 441,000 reached in 2022, according to ATTOM, Irvine, Calif.

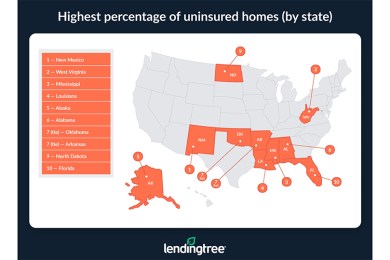

LendingTree: 13.6% of Homes Are Uninsured

LendingTree, Charlotte, N.C., reported approximately one in seven homes across the U.S. are uninsured.

FOMC Rate Pause Remains; MBA Economist Weighs In

The Federal Reserve’s Federal Open Market Committee left interest rates unchanged on Wednesday.