Home Flipping Declines Again, ATTOM Finds

(Illustration courtesy of Ivan Samkov/pexels.com)

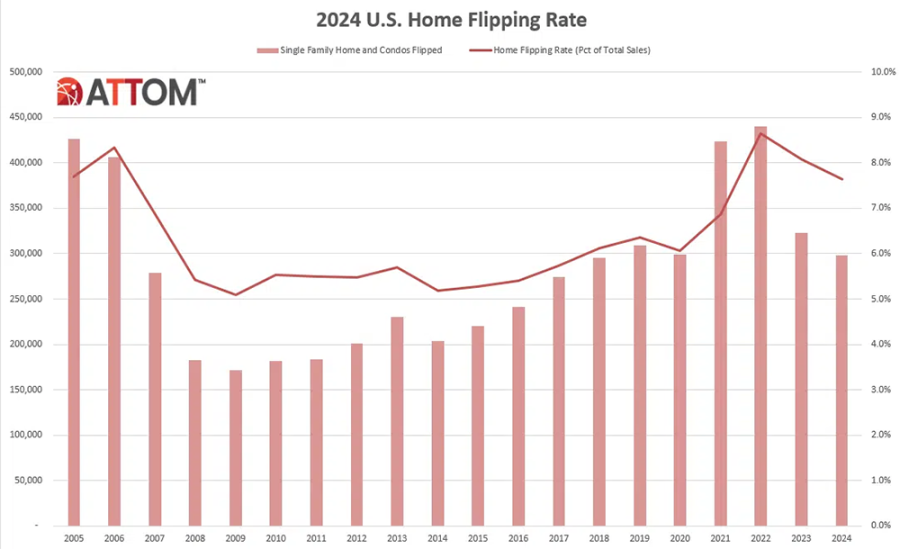

Nearly 298,000 single-family homes and condos in the United States were flipped last year, down 7.7% from 2023 and 32.4% from the recent peak of nearly 441,000 reached in 2022, according to ATTOM, Irvine, Calif.

ATTOM’s year-end U.S. Home Flipping Report also revealed that as the number of homes flipped by investors declined, so did flips as a portion of all home sales, from 8.1% in 2023 to 7.6% last year.

The report noted that profits and profit margins rose slightly in 2024 on typical buy-renovate-and-resell projects. “But margins again remained at one of their low points over the past 10 years as investors continued struggling to take advantage of the nation’s housing market boom,” ATTOM said.

The latest nationwide return on investment (before accounting for mortgage interest, property taxes, renovation expenses and other holding costs) was up from 28.6% in 2023 and from 29.4% in 2022. But it remained barely more than half of the 54.2% peak over the past decade in 2016, the report said.

“The home-flipping industry saw investors shy away even more in 2024 amid the extended period of languishing profits,” ATTOM CEO Rob Barber said. “But even as activity waned, there was at least a glimmer of hope that returns were starting to turn around. While home flippers still seemed to be having difficulty timing the market for big profits, their margins at least stopped going in the wrong direction.”

Barber added that 2025 poses “significant uncertainty” for investors, “what with a short supply of homes for sale, declining numbers of low-priced foreclosure properties, mixed economic forecasts and elevated mortgage rates. So, they will have to do some very smart buying and quick renovating to keep the profit rebound going.”