Optimal Blue: Refinances Surge in August

(Image courtesy of Optimal Blue)

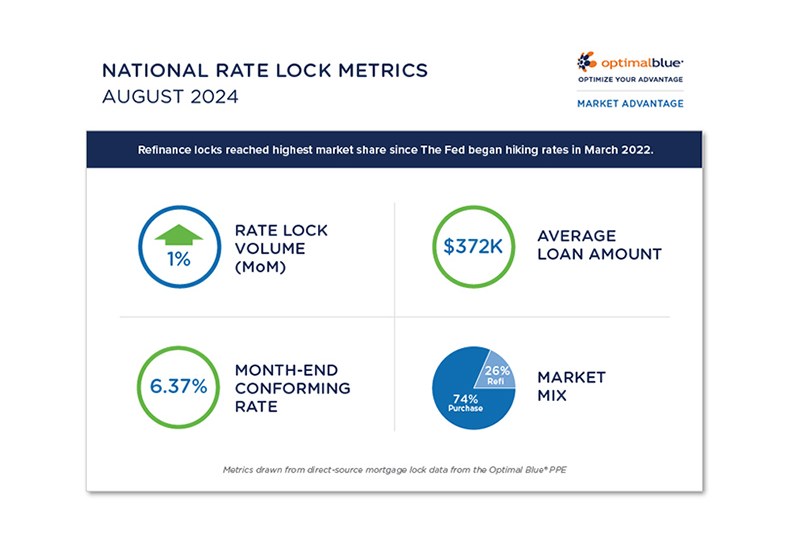

Optimal Blue, Plano, Texas, released its Market Advantage mortgage data report for August, revealing a 1% rise in overall rate lock volume, but more significant movement on refinances.

Refinances accounted for 26% of total production, the highest level since March 2022.

Rate-and-term refinance volume more than doubled in August, up 109% month-over-month. Cash-out refinances saw an increase of 8% month-over-month.

“Refinance activity, particularly rate-and-term refinances, surged as mortgage rates declined across all loan types,” said Brennan O’Connell, director of data solutions at Optimal Blue. “Notably, August saw a remarkable 109% month-over-month increase in rate-and-term refi volume in response to a 31-basis-point drop in the benchmark OBMMI 30-year conforming rate, which ended the month at 6.37%. Rate-and-term refi activity was up 300% from the same period last year.”

However, purchase volume fell by 10% month-over-month. Purchase lock counts are also down 16% year-over-year and down 45% compared with pre-pandemic August 2019.

The average loan amount rose from $369,100 to $372,400, but the average purchase price fell from $471,000 to $465,500.

Borrowers’ credit scores continue 2024’s trajectory and remain higher than average. For borrowers seeking purchase loans, they averaged 736.4, the highest on record going back to January 2018 when Optimal Blue began tracking the data.

The average credit score across all loan production for August was 731.