USMI: 64% of Buyers With Private Mortgage Insurance Are Purchasing First Home

(Image courtesy of USMI)

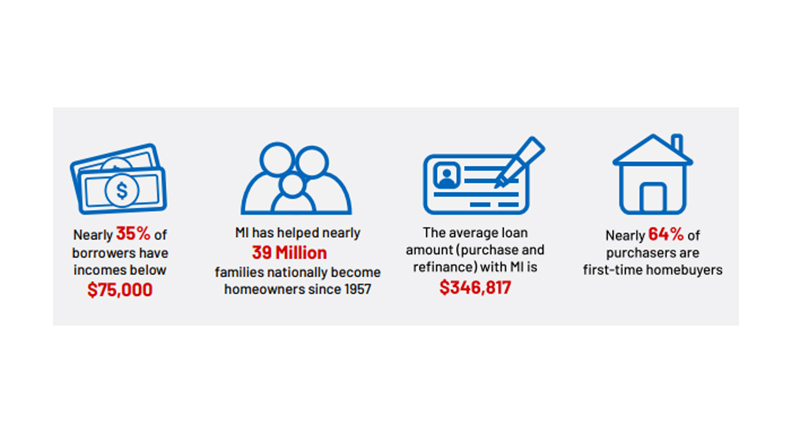

U.S. Mortgage Insurers, Washington, released a report finding that nearly 800,000 Americans used private mortgage insurance to purchase a home in 2023, and 64% were first-time buyers.

That compares with 61% recorded as first-time buyers as 2022, and is up 6 points since the pre-pandemic environment in 2019.

More than 98% of the loans with private MI were for new purchases.

The report noted that first-time buyers’ share of the private mortgage insurance market has increased 7% from 2020 to 2023.

Nearly 35% of the loans backed by private mortgage insurance went to borrowers with incomes below $75,000.

“Private mortgage insurance continues to help buyers qualify for financing and become homeowners with down payments as low as 3%, and remains one of the most important tools available to first-time and low- and moderate-income buyers in all market cycles,” said Seth Appleton, USMI President.

The average loan amount for a home purchased with private mortgage insurance in 2023 was $346,817, and the total value of mortgage originations supported by private mortgage insurance last year was about $283 billion.

In terms of location, Texas saw the most low down payment loans backed by private MI, at 70,446, followed by Florida at 54,190, California at 42,920, Illinois at 36,589 and Ohio at 33,649.