MBA Chart of the Week: Lender’s Loan Expense For Retail, Consumer Direct Channels

The longstanding MBA and STRATMOR Peer Group Roundtables Program (“PGR”) recently wrapped up its Spring 2024 season for benchmarking lender performance across various production channels and peer groups.

Based on a total sample of about sixty mortgage lenders, per-loan mortgage fulfillment expenses (processing, underwriting, closing, and other fulfillment costs) rose to new study-highs. For the retail channel, fulfillment costs reached $3,483 per loan originated, while in the consumer direct channel, fulfillment costs reached $4,077 per loan originated. Despite cost-cutting measures, it was tough for lenders to spread fixed costs over fewer loans. Compounding this predicament, typical variable costs were on the rise as well.

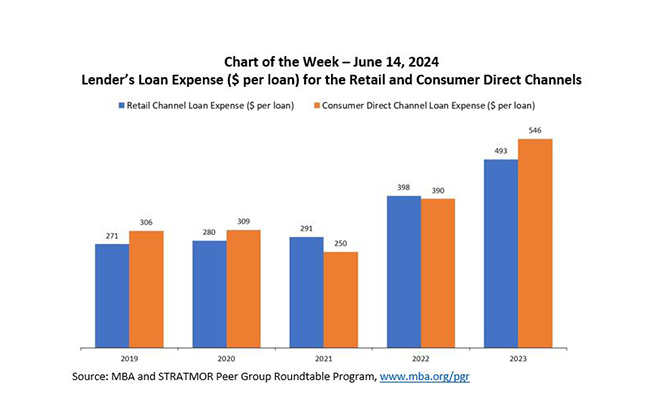

In this week’s Chart of the Week, we turn to one type of fulfillment cost – lender’s loan expense. Loan expense represents the lender’s cost (net of the fees received from the borrower) for appraisals, credit reports, flood certifications, homeowner’s association transfer fees, tax services, termite and other inspections, and other typical “pass-through” expenses. From 2019-2021, loan expense was fairly steady, averaging $281 per loan in the retail channel and $288 per loan in the consumer direct channel. However, between 2021-2023, loan expenses increased by almost 70 percent in the retail channel and 118 percent in the consumer direct channel on a per-loan basis.

Several possible factors may explain the rising loan expense. Pull-through (percentage of closings to applications) in the retail channel dropped from 75 percent in 2021 to 69 percent in 2023, while pull-through in the consumer direct channel dropped from 60 percent in 2021 to 43 percent in 2023. Lower pull-through could result in lenders paying for third-party costs on behalf of prospective borrowers who never end up closing on a loan.

Another reason for higher loan expense may be the rise in out of tolerance cures – or refunds paid by the lender to the borrower when the actual costs exceed the estimated disclosed costs by a certain threshold.

Finally, some mortgage lenders may not be seeking reimbursement from borrowers for the full amount of pass-through costs, even as third-party service charges increase.