Many Aspiring Homeowners Cite Cost of Living, Insufficient Income as Roadblocks: Bankrate

(IIlustration courtesy of Bankrate)

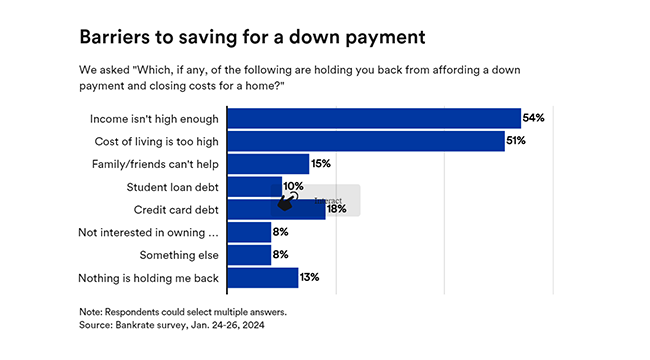

More than half of aspiring homeowners say the current cost of living is too high or their income is not high enough to afford a down payment and closing costs for a home (51% and 54% respectively), reported Bankrate, New York.

Bankrate’s Down Payment Survey found that aspiring homeowners cited credit card debt (18%), friends and family not being able to provide financial assistance (15%) and student loan debt (10%) as barriers to homeownership in addition to the high cost of living and low income.

“Just 13% of aspiring homeowners said nothing is holding them back,” Bankrate said.

The report said younger aspiring homeowners more often cite a lack of financial assistance from friends and family compared to older generations as an obstacle; Millennials are most likely to cite credit card debt and student loan debt.

“For prospective home buyers, debt can be the financial equivalent of quicksand suffocating capability and potentially blocking entry over the threshold of a dream home,” Bankrate Senior Economic Analyst Mark Hamrick said. “With credit card interest rates as high as they are, take heed of the flashing red light which warns us to avoid allowing debt to accumulate.”

Bankrate asked current homeowners how they paid for the down payment and closing costs for their first home. More than 40% said they saved money specifically for that purpose. Other methods included receiving a financial gift (14%) or a loan (9%) from friends or family, using a first-time homeowners grant or loan assistance program (14%), taking out money from retirement savings (9%), getting an additional source of income (8%), selling personal items (7%), or moving in with friends or family (6%).

But 20% of aspiring homeowners said they don’t think they will ever be able to save enough to purchase a home. Older generations (36% of Baby Boomers and 28% of Gen Xers) are more likely to believe they will never be able to save enough to buy a home, compared to 18% of Millennials and 10% of Gen Zers. “Nearly one-third of aspiring homeowners say it will take at least 5 years or longer to save enough money for a home, while 10% say it will take a decade or more,” Bankrate said.

Overall, more than 40% of those surveyed said they believe now is a bad time to buy a home, down from 49% who said that last September.

“If mortgage rates edge down this year as many expect, more Americans should find modest improvement with housing affordability,” Hamrick added. “Along with the interest rate question, it depends on the future direction of home prices and whether the market will continue to be dogged down by the thorny challenge of an insufficient supply of homes available for sale.”