FundingShield: Q4 2023 Analytics Show Significant Risk for Wire, Title Fraud

(Image courtesy of FundingShield)

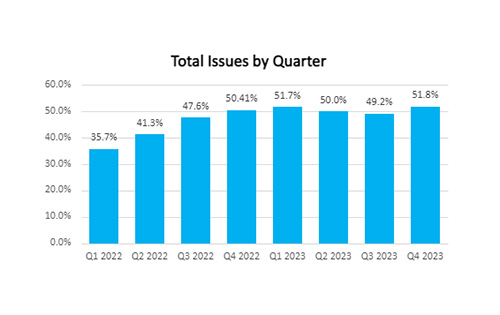

FundingShield, Newport Beach, Calif., reported wire and title fraud risk reached a high of 51.8% of loans on a $61 billion portfolio having at least one risk issue in the fourth quarter.

That’s up about 5% from Q3 2023, although FundingShield noted that the fourth quarter tends to be the highest for risk of fraud based on data from the past three years.

On average, problematic loans had 2.2 issues per loan.

CPL and CPL Validation/agent registration issues reached near all-time highs. CPL issues were found on 49.23% of transactions; CPL validation issues on 7.6% of transactions and wire risks on 8.45%.

The industry also had to contend with high-profile cybersecurity events, which FundingShield noted do tend to peak around the holidays.

In terms of changes between the third and fourth quarter, there was a roughly 30% increase in the rate of errors per loan.

There was a 22.28% increase in CPL-related issues from Q3 to Q4, 33.67% increase in wire-related issues and a 78.48% increase in license-related issues. CPL Validations, agent good standing, issuance limits or title file order registered in title insurer systems had a 35.85% increase in Q4 vs Q3 2023.