ICE Mortgage Monitor: Affordability Continues to Weigh on Market

(Image via ICE)

Intercontinental Exchange, Atlanta, released the November 2023 Mortgage Monitor Report, highlighting that high interest rates continue to drag down affordability and dampen demand.

The report is compiled by ICE subsidiary Black Knight.

The principal and interest payment needed to purchase a median-priced home is up by $144 a month over the past 30 days, notching above $2,500 (at $2,567) for the first time. That now requires 40.6% of the median household income.

The report noted that’s the least affordable housing market since 1984, and purchase applications are falling.

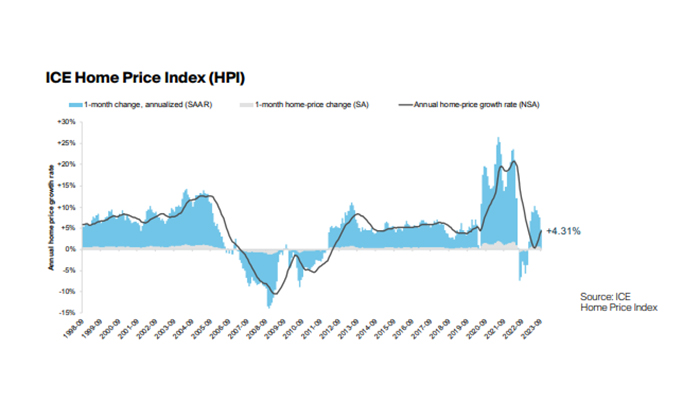

Annual home price growth was 4.3% in September; however, the seasonally adjusted monthly rise was the weakest since January at 0.39%.

“Historically tight inventory levels have been further bolstering prices, which hit yet another all-time high in September, with the annual growth rate accelerating to 4.3% from effectively flat just four months before,” said ICE Vice President of Enterprise Research Andy Walden. “That said, the pace of monthly gains slowed to +0.39% in September, marking the smallest seasonally adjusted gain since January. Rates are up 75 basis points from when September’s closed sales went under contract, which has cut consumer buying power by another 8% in the time since. Now, with rates above 7.5% and affordability at a 39-year low, it’s fair to expect prices to weaken later in 2023.”

Home sales inched up 1.6% in September on a seasonally adjusted basis, but remain near 2013-2014 levels.

Mortgage-holder equity is within 2% of record highs set in the third quarter of 2022. However, retention of consumers post re-financing is at a 17-year low.