MBA: 2022 Commercial and Multifamily Lending Down 8 Percent

Total commercial real estate mortgage borrowing and lending fell to $816 billion in 2022, an 8 percent decrease from the record $891 billion in 2021 but a 33 percent increase from $614 billion in 2020, the Mortgage Bankers Association reported Thursday.

MBA CREF Policy Update April 13, 2023

Commercial and multifamily developments and activities from MBA important to your business and our industry.

KBRA: Lodging Loan Performance Clouded by Upper-Upscale Chains

U.S. hotels have performed well overall since the pandemic, but upscale properties report higher commercial mortgage-backed securities delinquencies than more modest hotels, reported KBRA, New York.

Zillow: Rents Climb Modestly in March, Continuing Their Soft Landing

Apartment asking rents climbed 0.5%, or $9, from February to March, reported Zillow, Seattle.

Single-Tenant Net Lease Cap Rates Increase

Single-tenant net lease cap rates increased for the fourth consecutive quarter, the Boulder Group reported.

ULI: Office Sector in ‘Full State of Flux’

Offices are here to stay, but the sector is in ‘a full state of flux,’ said the Urban Land Institute, Washington, D.C., and Instant Group, London.

Dealmaker: Marcus & Millichap Closes $18M in Property Sales

Marcus & Millichap, Calabasas, Calif., closed two property sales in Washington and Ohio totaling $17.7 million.

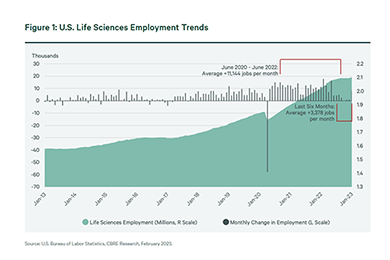

Life Sciences Properties Prove Resilient

Life sciences real estate assets are proving resilient during the current economic slowdown, reported CBRE, Dallas.