MBA: February Mortgage Application Payments Up 5%

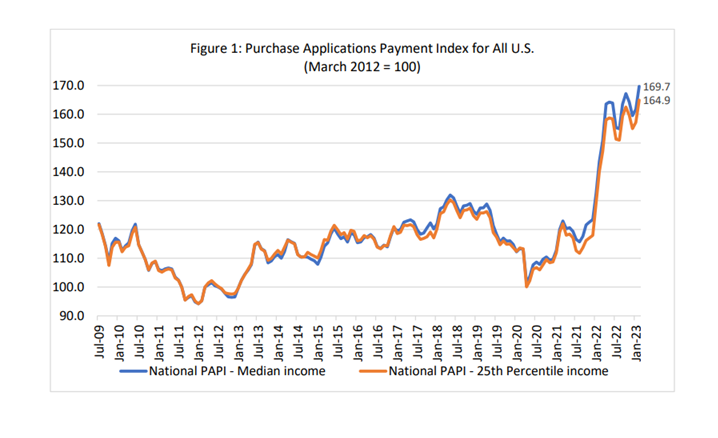

Homebuyer affordability declined in February, with the national median payment applied for by purchase applicants increasing 4.9 percent to $2,061 from $1,964 in January, according to the Mortgage Bankers Association’s monthly Purchase Applications Payment Index.

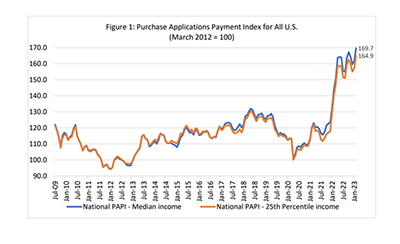

The national PAPI (Figure 1) increased 4.9 percent to 169.7 in February from 161.7 in January, a new high from its previous series peak in October 2022 at 167.2. From a year ago (143.7), the index is up 18.1 percent. For borrowers applying for lower-payment mortgages (the 25th percentile), the national mortgage payment increased to $1,391 in February from $1,322 in January.

The Builders’ Purchase Application Payment Index (BPAPI) showed that the median mortgage payment for purchase mortgages from MBA’s Builder Application Survey increased to $2,492 in February from $2,379 in January

“Higher mortgage rates and home prices led to continued erosion in homebuyer affordability in February,” said Edward Seiler, MBA Associate Vice President of Housing Economics, and Executive Director of the MBA Research Institute for Housing America. “Many prospective homebuyers continue to feel this affordability squeeze, with the typical purchase application loan amount increasing $8,003 over the month to $320,003.”

However Seiler noted given ongoing economic uncertainty and the likelihood of a recession, “MBA expects mortgage rates to decline as this year progresses, which will help affordability.”

PAPI measures how new monthly mortgage payments vary across time – relative to income – using data from MBA’s Weekly Applications Survey. An increase in PAPI – indicative of declining borrower affordability conditions – means that the mortgage payment to income ratio is higher due to increasing application loan amounts, rising mortgage rates, or a decrease in earnings. A decrease in the PAPI – indicative of improving borrower affordability conditions – occurs when loan application amounts decrease, mortgage rates decrease, or earnings increase.

Additional Key Findings of MBA’s Purchase Applications Payment Index for February:

• The national median mortgage payment rose to $2,061 in February, up from $1,964 in January and from $1,920 in December. It is up $408 from one year ago, a 24.7% increase.

• The national median mortgage payment for FHA loan applicants rose to $1,707 in February, up from $1,619 in January and from $1,201 in a year ago.

• The national median mortgage payment for conventional loan applicants rose to $2,117, up from $2,009 in January and from $1,750 in February 2022.

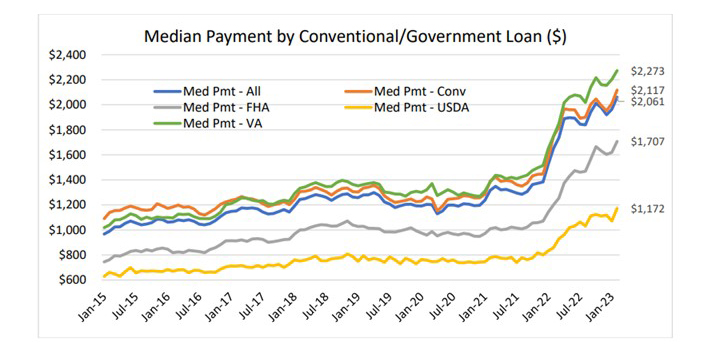

• States with the highest PAPI: Nevada (251.6), Idaho (249.3), Arizona (225.7), Utah (222.8) and California (217.4).

• States with the lowest PAPI: Connecticut (111.7), North Dakota (118.2), West Virginia (119.8), Louisiana (121.1) and Vermont (121.6).

• Homebuyer affordability decreased for Black households, with the national PAPI rising from 161.7 in January to 169.7 in February.

• Homebuyer affordability decreased for Hispanic households, with the national PAPI rising from 154.6 in January to 162.2 in February.

• Homebuyer affordability decreased for White households, with the national PAPI rising from 162.9 in January to 170.9 in February.