Housing Market Reports: Continued Declines in Home Price Appreciation; Affordability Improves

Three end-of-month home price reports found appreciation declining in many parts of the country, along with increased affordability in many markets.

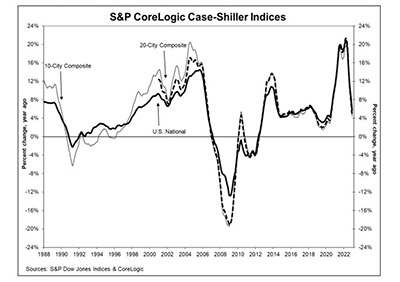

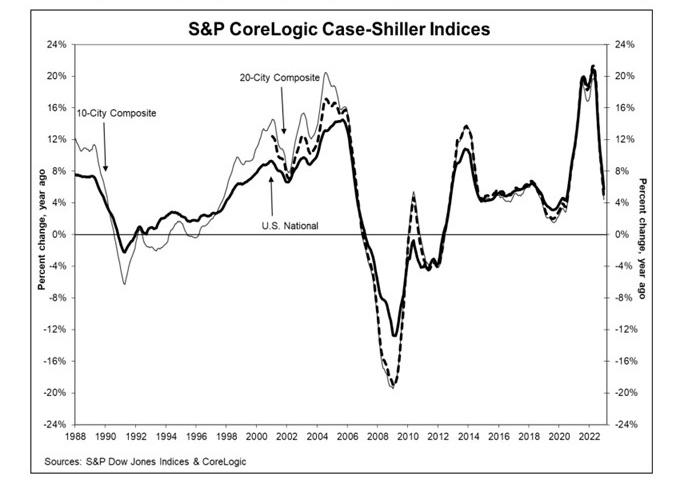

The monthly S&P CoreLogic Case-Shiller Indices reported a 5.8% annual gain in December, down from 7.6% in November, the sixth consecutive monthly decline. The 10-City Composite annual increase came in at 4.4%, down from 6.3% in November. The 20-City Composite posted a 4.6% year-over-year gain, down from 6.8% in the previous month.

Miami led the 20-City composite with 15.9% year-over-year price increase, followed by Tampa at 13.9% and Atlanta at 10.4%. All 20 cities reported lower prices in the year ending December from November.

Month-over-month, before seasonal adjustment, the U.S. National Index posted a -0.8% month-over-month decrease in December, while the 10-City and 20-City Composites posted decreases of -0.8% and -0.9%, respectively. After seasonal adjustment, the U.S. National Index posted a month-over-month decrease of -0.3%, and the 10-City and 20-City Composites posted decreases of -0.4% and -0.5%, respectively. All 20 cities reported declines both before and after seasonal adjustments.

“The cooling in home prices that began in June 2022 continued through year end,” said Craig J. Lazzara, Managing Director with S&P DJI. “The prospect of stable, or higher, interest rates means that mortgage financing remains a headwind for home prices, while economic weakness, including the possibility of a recession, may also constrain potential buyers. Given these prospects for a challenging macroeconomic environment, home prices may well continue to weaken.”

“With a full year of data, S&P CoreLogic Case-Shiller Index once again proved that 2022 was incredibly volatile for the housing market,” said CoreLogic Chief Economist Selma Hepp. “By all accounts, housing markets experienced historic highs and lows in a matter of months.”

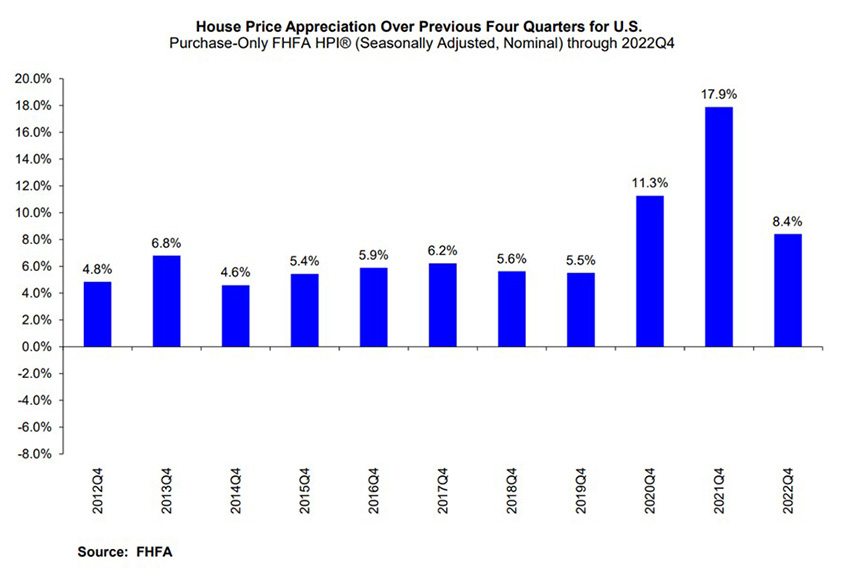

In a separate report, the Federal Housing Finance Agency reported U.S. house prices rose by 8.4 percent between the fourth quarters of 2021 and 2022. The FHFA House Price Index said house prices rose by 0.3 percent from the third quarter; FHFA’s seasonally adjusted monthly index for December was down 0.1 percent from November.

“House price appreciation continued to wane in the fourth quarter” said Nataliya Polkovnichenko, Supervisory Economist in FHFA’s Division of Research and Statistics. “House prices grew at a much slower pace in recent quarters amid higher mortgage rates and a decline in mortgage applications. These negative pressures were partially offset by historically low inventory.”

The report said house prices rose in all 50 states, while prices declined in the District of Columbia between the fourth quarters of 2021 and 2022. Areas with the highest annual appreciation were 1) Florida, 15.2 percent; 2) North Carolina, 13.4 percent; 3) South Carolina, 12.9 percent; 4) Hawaii, 12.8 percent; and 5) Maine, 12.2 percent. Areas showing the lowest annual appreciation were 1) District of Columbia, -0.8 percent; 2) California, 2.3 percent; 3) Idaho, 3.1 percent; 4) Oregon, 3.6 percent; and 5) Washington, 3.7 percent.

Meanwhile, First American Financial Corp., Santa Ana, Calif., said its monthly Real House Price showed housing affordability improved in December, the second consecutive monthly increase.

The report said real house prices decreased by 4.3 percent between November and December, but increased 48.3 percent year over year. Consumer house-buying power, how much one can buy based on changes in income and interest rates, increased by 4.9 percent between November 2022 and December 2022, but decreased 28.6 percent year over year.

The report noted median household income has increased 4.2 percent since December 2021 and 79.6 percent since January 2000. “Real” house prices are 34.2 percent more expensive than in January 2000, while unadjusted house prices are now 47.7 percent above the housing boom peak in 2006, while real, house-buying power-adjusted house prices are 6.1 percent above their 2006 housing boom peak.

“Nominal house price appreciation has slowed dramatically in response to dampened demand,” said Mark Fleming, chief economist with First American. “In November and December, falling mortgage rates and rising household incomes improved affordability by nearly 6 percent compared with October. Yet, as discussed in a previous analysis, affordability in the short run will be largely dictated by movements in mortgage rates and any increase in affordability may dissipate as mortgages rates have again drifted higher again in February.”

The report said states with the greatest year-over-year increase in the RHPI were Florida (+57.6), Vermont (+57.0 percent), Alabama (+56.8 percent), Maryland (+54.0 percent) and New Hampshire (+53.9 percent). No states posted a year-over-year decrease.

Among tracked by First American, markets with the greatest year-over-year increase in the RHPI were Miami (+67.8 percent), Indianapolis (+66.6 percent), Hartford, Conn. (+57.4 percent), Jacksonville, Fla. (+56.9 percent) and Orlando, Fla. (+56.1 percent). No markets posted a year-over-year decrease.